OUTSOURCING FOR AUDIT FIRMS

Audit Support Services

Learn how audit support services can help audit firms manage the demand for their services, address their challenges, and further boost their growth.

Audit support services can help audit firms achieve their goals. Read on to learn more.

GETTING STARTED | WHEN DO YOU NEED OUTSOURCED AUDIT SUPPORT | WHAT TO LOOK FOR IN AN AUDIT SUPPORT PROVIDER | WHAT TO LOOK FOR IN YOUR OUTSOURCED AUDIT TALENT | MAXIMIZING YOUR AUDIT SUPPORT | BEST PRACTICES IN OUTSOURCING | AUDIT OUTSOURCING IN THE DIGITAL AGE | ADVANTAGES OF OUTSOURCING | HOW TO MAKE OUTSOURCING WORK

GETTING STARTED

WHAT ARE AUDIT SUPPORT SERVICES?

Employing audit support services means being able to find outsourced audit solution partners that help ensure you have a smooth and effective audit service delivery process within your operations.

Outsourced partners usually specialize in audit solutions, among other finance and accounting proficiencies and offer a range of support solutions that help you streamline and optimize your audit services.

Audit support services involve support for the whole audit process, including the audit planning, execution, and conclusion phases. Competent service providers are also capable of writing reports, regardless of the standard requested by their clients.

DO I NEED AUDIT SUPPORT?

When your firm has already established their presence and already has a steady stream of clients availing your product offerings, the work to keep the business running starts to increase.

This is what we call a good problem. On the one hand, it means that your firm is healthily growing and expanding. On the other hand, it means you have to start increasing manpower, developing new ways for efficient operations and reassessing your company’s big picture. When faced with this kind of concern, finding an outsourced audit support partner may help you gain access to the audit talents and capabilities you need to address the demand for your services and maximize your firm’s growth potential.

WHEN DO YOU NEED OUTSOURCED SUPPORT?

INCREASING ADMINISTRATIVE AND OPERATIONS WORKLOAD

One of the key indicators you have to look out for is when your firm starts experiencing overwhelming administrative and operational responsibilities. From data entry, client paperwork up to your entire operations’ paper trail, if your current team finds themselves allocating too much time to these tasks, it means you must start thinking of employing support. If you allocate too much time to these tasks as you expand, you lose your competitive edge as your time is diverted from core business activities, and company growth initiatives.

MISSING OUT ON GROWTH OPPORTUNITIES

Aside from losing your competitive edge, audit firms may also consider outsourcing part of their operations when they miss out on growth opportunities by having to turn down quality leads or clients. This normally happens when you don’t have enough hands onboard to handle the increased workload. You’re not only missing out on additional income, but a possible partnership that can expand your firm’s capabilities and introduce you to even more clients.

NEED FOR ADDITIONAL SKILLS AND TALENTS

One of the biggest growing pains of audit firms is the need for talents who can help them increase their working capacity and match their standards. Often, having access to new talents gives audit firms an opportunity to expand their services, especially when the talents concerned introduce new skills to their practice. Through outsourcing, audit firms also tap into new talents that can help boost their firms’ capabilities and services.

RISK MANAGEMENT AND COMPLIANCE

As you expand your audit firm’s business and operations, it is only logical that the risks surrounding your practice will also increase. When this happens, you want to make sure you are on top of it all and remain compliant to smoothly continue your operations. This is why as you expand, having additional hands to take care of the nitty-gritty of your operations gives you the time to focus on eliminating these risks, ensuring your compliance with regulations, and helping your audit firm operate as efficiently as possible.

Knowing when you need additional support and employing the additional support needed aids your firm’s audit readiness and successful growth. By looking out for the signs, you can be prepared for the time getting additional support becomes an asset for your company, paving the way for you to focus on core tasks such as business development, business growth and investing in your network and professional relationships.

WHAT TO LOOK FOR IN AN AUDIT SUPPORT PROVIDER?

For all firms, finance and accounting processes are crucial functions to manage the services that you provide. However, when there are instances wherein the company doesn’t have enough manpower to conduct their own accounting and auditing, this becomes the time when outsourcing this function should be considered.

FACTORS TO CONSIDER IN HIRING OUTSOURCED AUDIT SERVICES

A professional and reputable outsourced audit support offers best practices in financial management, documentation and regulatory compliance. They are also able to help streamline your audit processes to optimize current workflows. This is why when outsourcing your firm’s audit services, performance and efficiency should be top priority. Depending on the goals of your firm, there are standard criteria that must be considered.

WHAT SERVICES DO YOU NEED?

What services do you need from the firm? Is it tax preparation and financial reports, audit support from start to finish, audit recommendations, general audit services? Outsourced partners that offer these services are specialized in the field of finance and accounting and would be able to help you with your specific needs.

HOW WILL THEY SECURE YOUR DATA?

Data security plays a very crucial role when outsourcing your audit needs. A reputable outsourced partner manages their client’s data with the utmost privacy and ensures that each transaction is secure. Remember, not only are you handing over cash flow information to them, but as well as sensitive data so they should have ironclad privacy protocols for every client that they are handling.

DO THEY MATCH YOUR BUDGET?

Each outsourced audit partner has their payment system—some charge by the hour or monthly. Whatever payment term suits best your budget, go for it; just make sure that you get what you are paying for.

Cost is an important factor in enhancing business performance and is also one of the factors as to why companies choose to outsource their accounting services, so based on the type of service that you need, find providers who are able to give you a good price for their services.

HOW WILL THEY FIT YOUR PROCESS?

Besides the services that your chosen partner offers, the outsourced partner should also be open to collaboration. Outsourcing is also an opportunity to learn so your in-house team should be able to assist you with extra information, advice and suggestions that can improve your finance and accounting processes.

These are just some of the factors you need to consider when looking for audit readiness and accounting operations support services. Above all, do not forget to look for an experienced outsourced partner to ensure that they will meet your requirements at the agreed time.

WHAT TO LOOK FOR IN YOUR OUTSOURCED AUDIT TALENT?

When looking for an outsourcing partner, one thing you should look for is the qualifications of their talents and how they aid their professional development to make sure that they are able to handle your needs and any developments that may occur throughout your engagement. With this, here are some of the qualities you should look at in the talents your outsourcing provider has to offer:

KNOWLEDGE OF GAAP, IFRS, AND OTHER REGULATORY REQUIREMENTS

All finance and accounting outputs by firms should be in compliance with the regulations concerning their clients’ industries. By employing partners that are knowledgeable of these requirements you become credible in providing quality assured services to your clients.

EXPERIENCE WITH THE BIG 4 FIRMS

Experience in the Big Four Accounting Firms (Deloitte, EY, KPMG and PwC) are highly regarded in the finance and accounting industry due to their experience in handling clients from everywhere in the world and their ability to adapt to different financial landscapes. By employing the help of professionals with experience in the Big Four, you are employing adaptable individuals who can help guide your clients through any financial changes.

KNOWLEDGEABLE WITH THE LATEST TECHNOLOGY AND TRENDS

The finance and accounting landscape nowadays has heavily integrated technology into their everyday workflow. As technology evolves, so does the different software we use in industry. With the continuous emergence of new technology, it is important that you employ the services of professionals who make it a priority to stay up to date in the latest technology and accounting trends to close any gaps that may occur in your current accounting workflow as technology progresses.

MAXIMIZING YOUR AUDIT SUPPORT

Outsourcing allows firms to get the support they need to manage their workload at a reduced cost than having to employ an in-house team. They provide maximum efficiency given that the outsourced partner gives undivided attention to the tasks outsourced to them. However, outsourcing isn’t a magic solution that automatically makes everything better, you must take certain steps to ensure that it works for you.

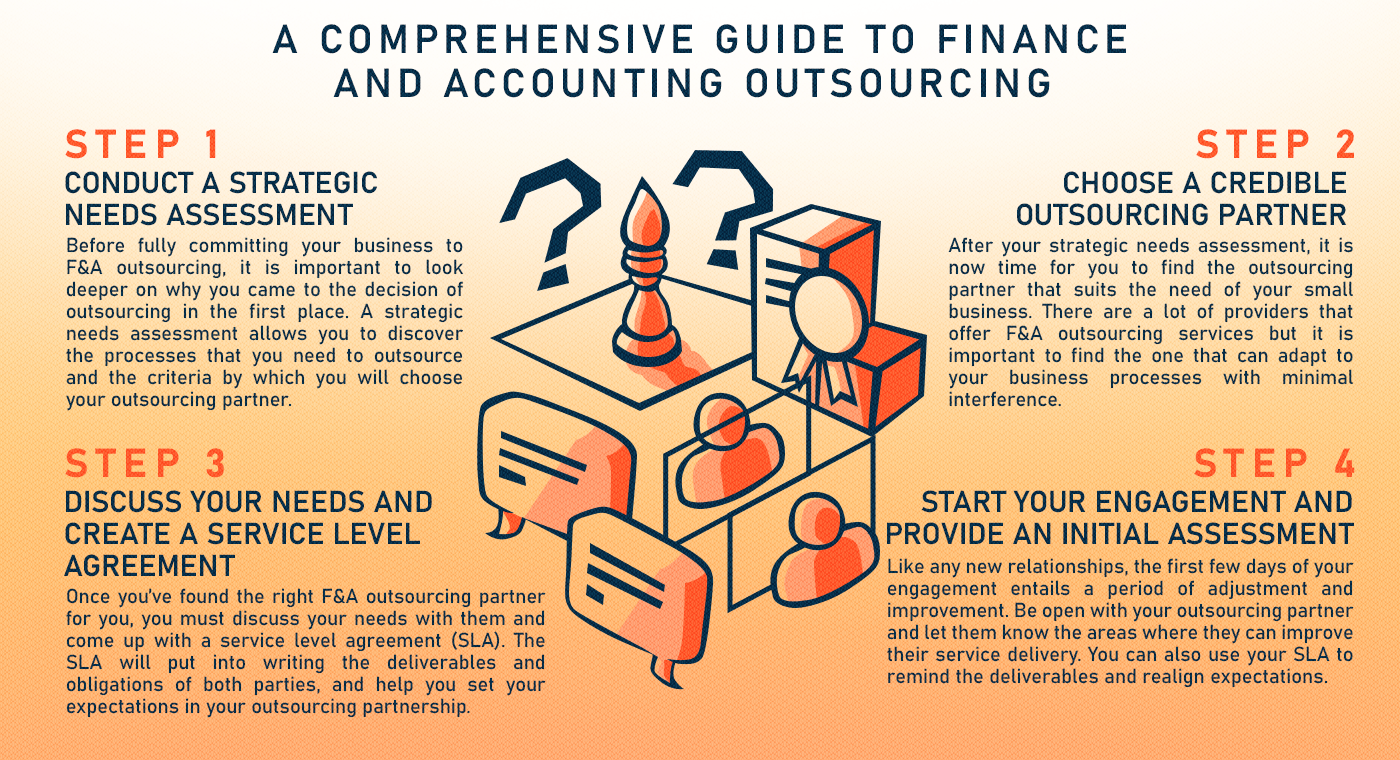

To make outsourcing an effective strategy for your firm, work your way down this checklist when finding a partner:

1. SET OBJECTIVES

Properly list and plan out all the services you need to outsource, this will allow you to make cost-effective decisions as you can choose a partner that provides all the services you require.

2. CHOOSE THE RIGHT PARTNER

Choose a partner who can provide all the services you require with proven experience and core competencies that complement your business’ current processes.

3. DEFINE SCOPE OF OBJECTIVES

Clearly define the scope of the services your firm needs. This works well for both of you and your partner as you’ll be able to clear which aspects of your firm you can outsource and let them know what they need to focus on, allowing both of you to produce quality outputs.

4. CREATE TIMELINE

Work together to create a timeline for your partner’s deliverables. Set achievable goals and deadlines so that you’ll be able to assess their progress and see how they are contributing to your business.

5. PROVIDE THE RIGHT ACCESS

Ensure that your outsourced team can access all the things they need to work on their tasks effectively from the start. This ensures smooth progress with no hiccups, making their work easier and allowing you to see results faster.

6. QUALITY CONTROL

Designate one person on your team to be the one to maintain communication with your outsourcing partner AND oversee quality control. Conduct routine quality control assessments on your partner’s outputs to make sure it is in accordance with your business’ standards. You can also check the quality assurance process of your outsourcing partner and see if it is aligned with yours.

7. CONSTANT COMMUNICATION

Build a professional relationship with your partner and establish constant communication with them for transparency on the progress of their tasks.

8. EVALUATE

After implementing everything on this checklist, evaluate the effects that your partner has had on your firm. Have your businesses processes been successfully streamlined? Have your client outputs improved? Is the overall improvement in quality and efficiency evident?

Offshoring your audit work remains the best tool for companies and firms to combat the ever-changing needs of clients, but it needs careful guidance. Without setting certain parameters, it may just give you more to think about instead of lessening your load. By following this checklist and creating an effective outsourcing strategy, you can make your outsourcing experience a pleasurable one and ensure that it will have a positive effect on your firm – helping you grow and stay competitive amidst the constant change in the finance and accounting world.

THE DO'S AND DON'TS OF OUTSOURCING

Outsourcing has become a popular strategy for companies and firms alike looking to streamline operations, reduce costs, and focus on their core competencies. However, it's not a one-size-fits-all solution, and there are important considerations to keep in mind to ensure success.

Keep in mind that outsourcing comes with its own set of advantages and disadvantages. To make sure you follow the do's and don'ts when employing audit support services, we've run it down for you.

THE DO'S OF OUTSOURCING

CLEARLY DEFINE YOUR OBJECTIVES

Before you begin outsourcing, define your objectives and expectations clearly. Understand what you want to achieve by outsourcing, whether it's cost savings, improved efficiency, or access to specialized expertise.

CHOOSE THE RIGHT PARTNER

Selecting the right outsourcing partner is crucial. Look for a reputable provider with a proven track record in your industry. Conduct due diligence, check references, and evaluate their capabilities.

ESTABLISH STRONG COMMUNICATION

Effective communication is the cornerstone of successful outsourcing. Maintain open and transparent lines of communication with your outsourcing partner to ensure they understand your needs and expectations.

SET KEY PERFORMANCE INDICATORS (KPIs)

Define key performance indicators to measure the success of the outsourcing arrangement. Regularly review these KPIs to ensure that your outsourcing partner is meeting your goals.

THE DON'TS OF OUTSOURCING

RUSHING TO OUTSOURCING

Rushing into an outsourcing relationship without proper due diligence can lead to costly mistakes. Take the time to thoroughly research and vet potential outsourcing partners.

MICROMANAGING YOUR OUTSOURCED STAFF

While it's essential to maintain oversight, avoid micromanaging your outsourcing team. Trust your partner's expertise and give them the freedom to perform the tasks they were hired for.

SACRIFICING QUALITY FOR COST

Cost savings are a significant driver for outsourcing, but don't compromise on quality. Ensure that your outsourcing partner can deliver the level of quality and service your business demands.

UNCLEAR COMMUNICATION LINES

Miscommunication can lead to delays and misunderstandings. Clearly articulate your expectations and requirements and encourage your outsourcing team to seek clarification when needed.

DISREGARDING DATA SECURITY

Protecting sensitive data is paramount and offshoring your audit work comes with a certain level of risk. To combat this, implement robust data security measures and ensure that your outsourcing partner follows strict security protocols to safeguard your information.

IGNORING THE IMPORTANCE OF LEGAL AGREEMENTS

Draft comprehensive legal agreements that outline the terms and conditions of your outsourcing relationship. Clearly define roles, responsibilities, payment terms, and dispute resolution processes.

Outsourcing can be a strategic move for your company, but it requires careful planning and execution. By following these do's and don'ts, you can maximize the benefits of outsourcing while mitigating potential risks. Remember that outsourcing is a dynamic process, and ongoing communication and evaluation are key to its long-term success.

OUTSOURCING YOUR AUDIT NEEDS IN THE DIGITAL AGE

With the advent of digitalization and how technological innovations are being integrated intro most industries --- including the finance and accounting industry --- it is important that you find an outsourced partner who is proficient in the latest in finance and accounting technology. This ensures that you remain adaptable and able to provide quality services however the finance landscape develops. By employing the help of a proficient outsourced partner, you are securing your plane in this technology-driven times.

As you look for a finance and accounting technologically proficient partner, keep in mind some of how they have integrated it into their own work processes. For their part, audit professionals have developed audit methods that fit their client’s digital processes. Here are some of the things you can look out for when choosing an adaptable and proficient partner.

DIGITAL AUDIT IN THE WORKSPACE

Partners that embrace a digital audit workspace have become highly valuable due to the efficient and cost-effective set up that they provide. A digital audit workplace not only streamlines the entire audit process but allows for real-time data sharing and collaboration, a handy tool that increases the transparency between your firm and your client. This results in higher trust, quicker audits and overall better client experience.

AN UPDATED KNOWLEDGE OF THE AUDIT INDUSTRY

A partner who stays updated on all the changes in the finance and accounting industry and all things audit-related is an asset for firms who are in the audit business. As is the norm, the audit industry constantly evolves -- as new regulations, standards and trends are adapted, we have been used to regular changes which at times is hard to keep up with.

By outsourcing your audit support to a partner who makes it a point to keep up with all the changes, you are securing your firm's compliance and allowing you to handle any changes that may occur.

It is important for auditors to equip themselves with fresh knowledge in audit methods and technology. Failure to do so will result to output that is generic and irrelevant to their business objectives.

ROBUST SECURITY MEASURES

With how technology has evolved, so has the nature of threats – things such as ransomware, viruses and hacking are a constant risk as we digitalize our processes, which is why it is important for firms to have robust security measures. To protect their interests, outsourced partners have implemented their own cybersecurity measures to protect the data of their clients. The last thing any service-oriented firm needs is the mismanagement or security breach of their data or the data of their clients.

Audit technology has come a long way in helping outsourced audit support advance their practice in the digital world. Utilizing the latest technology and employing the help of those who are proficient in technological changes in the audit industry allows you to deliver better, more accurate, and more relevant output in the digital world.

ADVANTAGES OF OUTSOURCING

Outsourcing can offer numerous benefits to companies and firms, including cost savings, access to specialized expertise, increased efficiency, audit readiness and overall accounting operations support. However, maintaining a strong and healthy relationship with your outsourced provider is crucial to ensure that these benefits continue to flow.

By building a balanced and professional work relationship with your outsourced partner, you will be able to efficiently work together to achieve your common goals.

HOW TO MAKE IT WORK WITH YOUR OUTSOURCED PARTNER

1. SET CLEAR EXPECTATIONS

Misaligned expectations can lead to frustration and misunderstandings. Clearly define your objectives, roles, and responsibilities in your outsourcing agreement. Be specific about timelines, deliverables, and performance metrics. When both parties have a crystal-clear understanding of their roles, it becomes easier to address any issues that may arise.

2. BUILD TRUST AND TRANSPARENCY

Trust is the foundation of a successful outsourcing relationship. Trust your outsourced provider's expertise and judgment, and encourage them to be transparent about their processes, challenges, and potential solutions. Transparency fosters a sense of partnership and enables both parties to work together towards common goals.

3. MANAGE EXPECTATIONS AND REALITY

It's important to remember that outsourced providers, like any other business, may face limitations and challenges. Be prepared for the occasional setback or hiccup and avoid unrealistic expectations. A collaborative approach to problem-solving is often more productive than assigning blame.

4. FLEXIBILITY AND ADAPTABILITY

The business landscape is dynamic, and your outsourcing needs may evolve over time. Be open to adjusting your outsourcing arrangements to accommodate changing circumstances. A flexible approach can help you stay agile and responsive to market changes.

5. REGULAR PERFORMANCE EVALUATION

Implement a system for regular performance evaluations. Set key performance indicators (KPIs) and review them periodically with your outsourced provider. This not only ensures accountability but also provides an opportunity to identify areas for improvement.

6. CONFLICT RESOLUTION MECHANISM

No partnership is without disagreements. Establish a clear process for resolving conflicts, whether they relate to quality issues, contractual disputes, or other challenges. Having a predefined mechanism in place can prevent minor issues from escalating.

7. INVEST IN RELATIONSHIP BUILDING

Finally, invest time in building a strong relationship with your outsourced provider. Visit their facilities, if possible, attend team-building activities, and foster a sense of camaraderie. A strong personal connection can go a long way in strengthening your partnership.

By following these strategies, you can overcome challenges and work together toward shared success. Remember that a successful partnership is built on mutual trust, understanding, and a shared commitment to achieving common goals.

TIME TO GET STARTED!

Outsourcing some of your audit functions is a big decision that should not be taken lightly -- especially for firms who have not yet tried offshoring their audit work. While there are a lot of benefits to having an outsourced partner, you should still consider whether your firm’s business model and workflow compliments that of your partners. If it does and when the time comes that you find a partner that checks all the boxes, then it’s time to begin outsourcing your audit support.

To further help you in making the decision on whether or not employ the help of a reliable outsourced partner, you may download our Seasonal Audit Support for US Audit Firms and discover how our audit work offshore services from right here in the Philippines can help you deliver quality services even during busy audit season, increased workflow and day-to-day audit operations

Want to receive audit resources straight to your inbox? Subscribe to our newsletter.

Be the first to access our finance and accounting resources for CFOs. We only send newsletters occasionally. This way, we make sure to deliver well-curated content that gives value.

INTERESTED IN KNOWING MORE? LET’S TALK.

We’re excited to know how we can help you. If you’ve got any questions about our services, hit any of the buttons below.