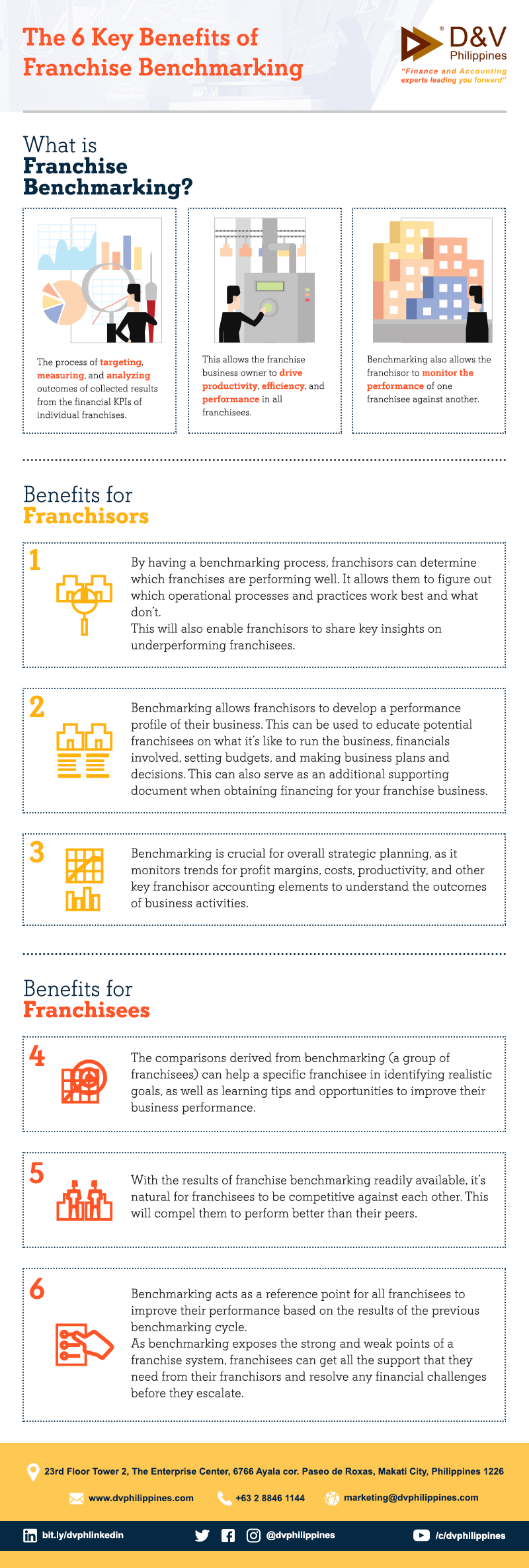

The 6 Key Benefits of Franchise Benchmarking

Financial benchmarking is crucial for both franchisors and franchisees. Operators of business franchises can keep their business running smoothly by continually measuring and comparing their performance against industry averages.

Using key performance indicators (KPIs) and other benchmarking guides, a franchise owner can measure how their business stack against other franchises in the same group. The best franchise systems can also use industry benchmarks set by accounting firms or universities to gauge how they rank against their competitors.

What is Franchise Benchmarking?

- The process of targeting, measuring, and analyzing outcomes of collected results from the financial KPIs of individual franchises.

- This allows the franchise business owner to drive productivity, efficiency, and performance in all franchisees.

- Benchmarking also allows the franchisor to monitor the performance of one franchisee against another.

Benchmarking for Franchise Business

Benefits for Franchisors

As a franchisor, it’s important to be fully aware of your franchises’ financial health in order to maximize their profitability. This is where financial benchmarking can help.

- By having a benchmarking process, franchisors can determine which franchises are performing well. It allows them to figure out which operational processes and practices work best and what don’t. This will also enable franchisors to share key insights on underperforming franchisees.

By having a system in place for measuring benchmark for franchises, a franchise business owner can pinpoint which areas in their business need immediate attention and support.

- Benchmarking allows franchisors to develop a performance profile of their business. This can be used to educate potential franchisees on what it’s like to run the business, financials involved, setting budgets, and making business plans and decisions.

This can also serve as an additional supporting document when obtaining financing for your franchise business. (No need to add the links JV, this is only for on-page SEO purposes)

- Benchmarking is crucial for overall strategic planning, as it monitors trends for profit margins, costs, productivity, and other key franchisor accounting elements to understand the outcomes of business activities.

Benefits for Franchisees

For franchisees, financial benchmarking can help everyone develop financial KPIs that franchisees of all sizes can strive for.

- The comparisons derived from benchmarking (a group of franchisees) can help a specific franchisee in identifying realistic goals, as well as learning tips and opportunities to improve their business performance.

- With the results of franchise benchmarking readily available, it’s natural for franchisees to be competitive against each other. This will compel them to perform better than their peers.

- Benchmarking acts as a reference point for all franchisees to improve their performance based on the results of the previous benchmarking cycle.

As benchmarking exposes the strong and weak points of a franchise system, franchisees can get all the support that they need from their franchisors and resolve any financial challenges before they escalate.

Talk to D&V Philippines’ Franchise Accountants

Still unsure how benchmarks fit into the overall picture of your business? D&V Philippines’ roster of expert franchise accountants can help you get started. Contact us and learn about the benefits of franchise benchmarking.

We can also help you establish and implement a franchise benchmarking process that will improve performance visibility and promote efficiency in your system.

Send us a message today to set up a free consultation with our finance and accounting consultants. To learn more about our targeted solutions for franchise owners, read our whitepaper, Specialised Finance & Accounting Solutions to Leverage Your Franchise Business.