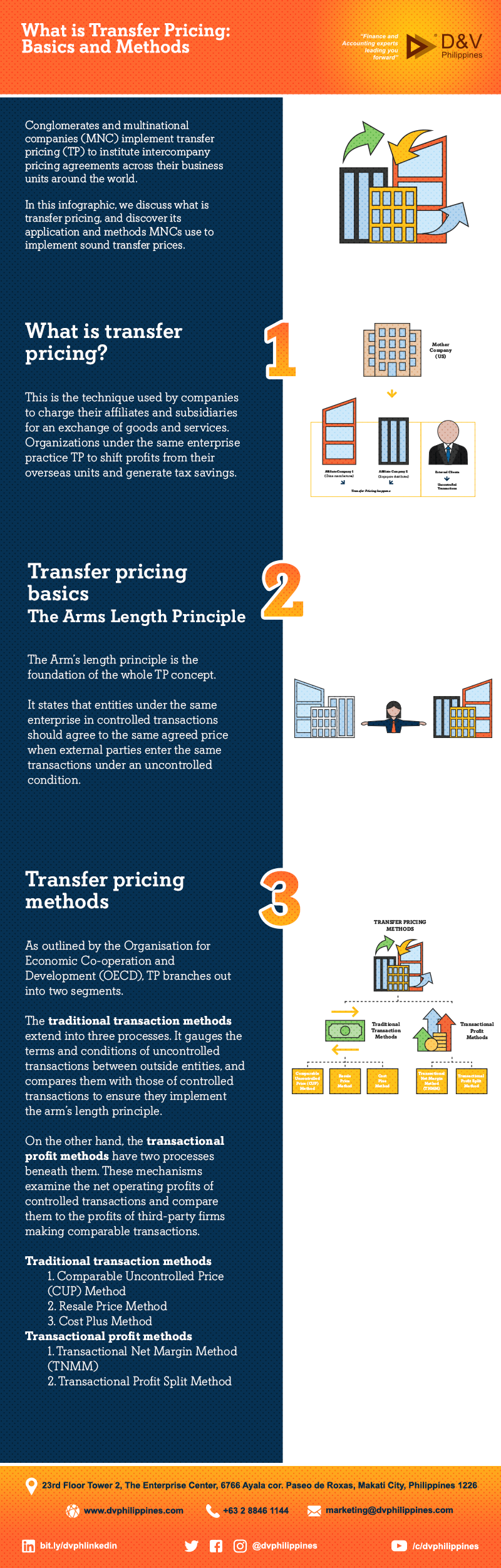

What is Transfer Pricing: Basics and Methods

Conglomerates and multinational companies (MNC) implement transfer pricing (TP) to institute intercompany pricing agreements across their business units around the world.

In this infographic, we discuss what is transfer pricing, and discover its application and methods MNCs use to implement sound transfer prices.

1. What is transfer pricing?

This is the technique used by companies to charge their affiliates and subsidiaries for an exchange of goods and services. Organizations under the same enterprise practice TP to shift profits from their overseas units and generate tax savings.

2. Transfer pricing basics

The Arms Length Principle

The Arm’s length principle is the foundation of the whole TP concept.

It states that entities under the same enterprise in controlled transactions should agree to the same agreed price when external parties enter the same transactions under an uncontrolled condition.

3. Transfer pricing methods

As outlined by the Organisation for Economic Co-operation and Development (OECD), TP branches out into two segments.

The traditional transaction methods extend into three processes. It gauges the terms and conditions of uncontrolled transactions between outside entities, and compares them with those of controlled transactions to ensure they implement the arm’s length principle.

On the other hand, the transactional profit methods have two processes beneath them. These mechanisms examine the net operating profits of controlled transactions and compare them to the profits of third-party firms making comparable transactions.

Traditional transaction methods

- Comparable Uncontrolled Price (CUP) Method

- Resale Price Method

- Cost Plus Method

Transactional profit methods

- Transactional Net Margin Method (TNMM)

- Transactional Profit Split Method

With a profound understanding of what transfer pricing is, you can use TP methods properly to leverage lower taxes and generate higher profit margins.

However, if it comes across as intimidating for your team to do, we can take the brunt off your hands. D&V Philippines offers Transfer Pricing Services and other finance and accounting services for growing companies like yours.

Grab your copy of our whitepaper Outsourcing: How to Make it Work to know how our TP and F&A solutions support your financial growth or contact us today to schedule a free consultation.