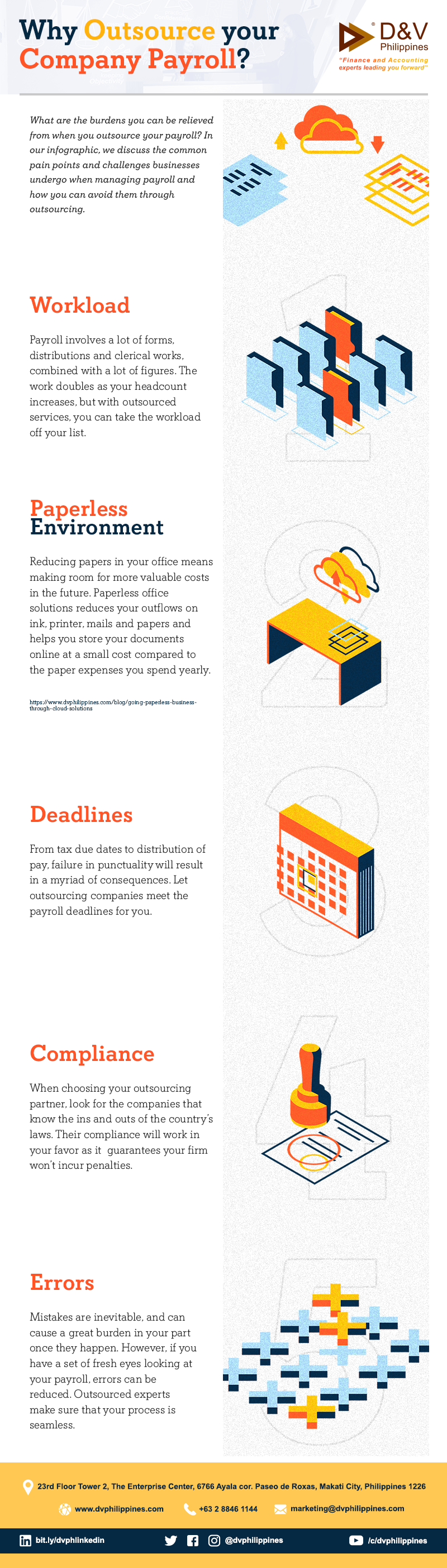

5 Reasons to Outsource your Company Payroll to Accounting Experts

What are the burdens you can be relieved from when you outsource your payroll? In our infographic, we discuss the common pain points and challenges businesses undergo when managing payroll and how you can avoid them through outsourcing.

1. Workload

Payroll involves a lot of forms, distributions, and clerical works, combined with a lot of figures. The work doubles as your headcount increases, but with outsourced services, you can take the workload off your list.

2. Paperless Environment

Reducing papers in your office means making room for more valuable costs in the future. Paperless office solutions reduce your outflows on ink, printer, mails, and papers, and helps you store your documents online at a small cost compared to the paper expenses you spend yearly.

3. Deadlines

From tax, due dates to the distribution of pay, failure in punctuality will result in a myriad of consequences. Let outsourcing companies meet the payroll deadlines for you.

4. Compliance

When choosing your outsourcing partner, look for the companies that know the ins and outs of the country’s laws. Their compliance will work in your favor as it guarantees your firm won’t incur penalties.

5. Errors

Mistakes are inevitable and can cause a great burden on your part once they happen. However, if you have a set of fresh eyes looking at your payroll, errors can be reduced. Outsourced experts make sure that your process is seamless.

Find out how you can successfully outsource your payroll with D&V Philippines. Download our "Australian Payroll Made Easy" below and see how payroll outsourcing can help you focus more on your business.