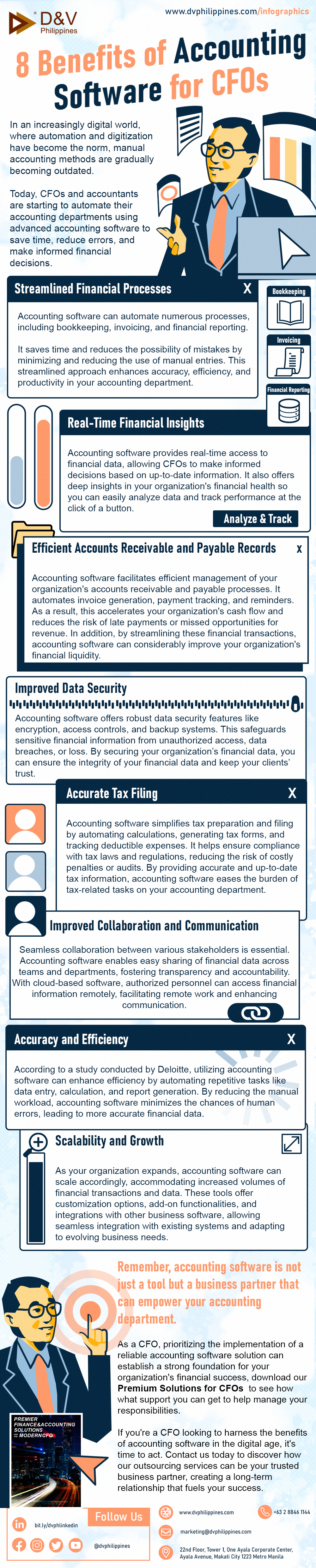

8 Benefits of Accounting Software for CFOs

In an increasingly digital world, where automation and digitization have become the norm, manual accounting methods are gradually becoming outdated. Today, CFOs and accountants are starting to automate their accounting departments using advanced accounting software to save time, reduce errors, and make informed financial decisions.

The Benefits of Using Accounting Software for CFOs

1. Streamlined Financial Processes

Accounting software can automate numerous processes, including bookkeeping, invoicing, and financial reporting. It saves time and reduces the possibility of mistakes by minimizing and reducing the use of manual entries. This streamlined approach enhances accuracy, efficiency, and productivity in your accounting department.

2. Real-Time Financial Insights

Accounting software provides real-time access to financial data, allowing CFOs to make informed decisions based on up-to-date information. It also offers deep insights in your organization's financial health so you can easily analyze data and track performance at the click of a button.

3. Efficient Accounts Receivable and Payable Records

Accounting software facilitates efficient management of your organization's accounts receivable and payable processes. It automates invoice generation, payment tracking, and reminders. As a result, this accelerates your organization's cash flow and reduces the risk of late payments or missed opportunities for revenue. In addition, by streamlining these financial transactions, accounting software can considerably improve your organization's financial liquidity.

4. Improved Data Security

Accounting software offers robust data security features like encryption, access controls, and backup systems. This safeguards sensitive financial information from unauthorized access, data breaches, or loss. By securing your organization’s financial data, you can ensure the integrity of your financial data and keep your clients’ trust.

5. Accurate Tax Filing

Accounting software simplifies tax preparation and filing by automating calculations, generating tax forms, and tracking deductible expenses. It helps ensure compliance with tax laws and regulations, reducing the risk of costly penalties or audits. By providing accurate and up-to-date tax information, accounting software eases the burden of tax-related tasks on your accounting department.

6. Improved Collaboration and Communication

Seamless collaboration between various stakeholders is essential. Accounting software enables easy sharing of financial data across teams and departments, fostering transparency and accountability. With cloud-based software, authorized personnel can access financial information remotely, facilitating remote work and enhancing communication.

7. Accuracy and Efficiency

According to a study conducted by Deloitte, utilizing accounting software can enhance efficiency by automating repetitive tasks like data entry, calculation, and report generation. By reducing the manual workload, accounting software minimizes the chances of human errors, leading to more accurate financial data.

8.Scalability and Growth

As your organization expands, accounting software can scale accordingly, accommodating increased volumes of financial transactions and data. These tools offer customization options, add-on functionalities, and integrations with other business software, allowing seamless integration with existing systems and adapting to evolving business needs.

As a CFO, prioritizing the implementation of a reliable accounting software solution can establish a strong foundation for your organization's financial success, download our Premium Solutions for CFOs to see how what support you can get to help manage your responsibilities.

If you're a CFO looking to harness the benefits of accounting software in the digital age, it's time to act. Contact us today to discover how our outsourcing services can be your trusted business partner, creating a long-term relationship that fuels your success.