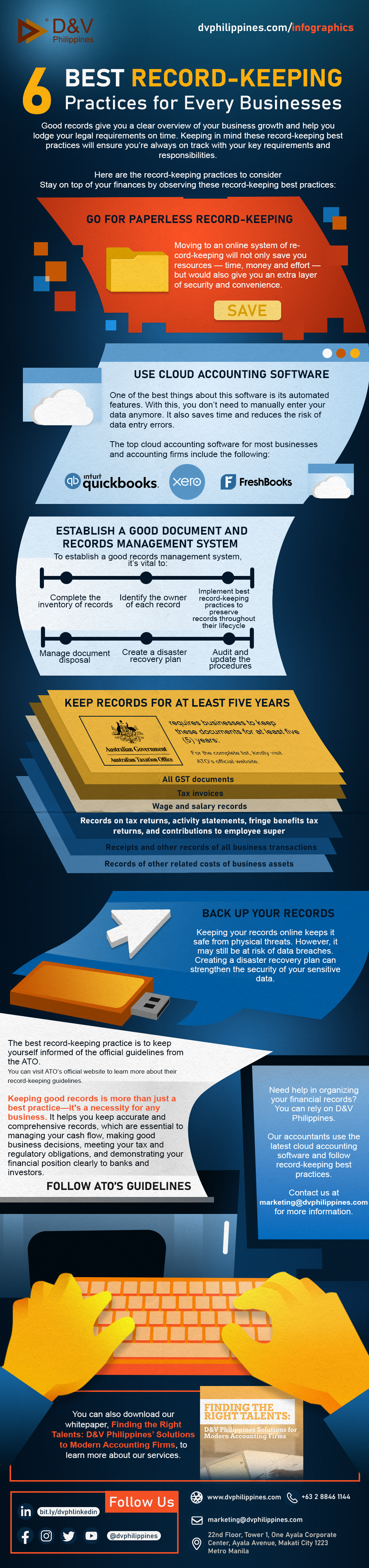

6 Best Record-Keeping Practices for Every Businesses

Good records give you a clear overview of your business growth and help you lodge your legal requirements on time. Keeping in mind these record-keeping best practices will ensure you’re always on track with your key requirements and responsibilities.

Here are the record-keeping practices to consider

Stay on top of your finances by observing these record-keeping best practices:

1. Go for paperless record-keeping

Moving to an online system of record-keeping will not only save you resources — time, money and effort — but would also give you an extra layer of security and convenience.

2. Use cloud accounting software

One of the best things about this software is its automated features. With this, you don’t need to manually enter your data anymore. It also saves time and reduces the risk of data entry errors.

The top cloud accounting software for most businesses and accounting firms include the following:

- Xero

- QuickBooks Online

- FreshBooks

3. Establish a good document and records management system

To establish a good records management system, it’s vital to:

- complete the inventory of records,

- identify the owner of each record,

- determine how long to keep these records,

- implement best record-keeping practices to preserve records throughout their lifecycle,

- manage document disposal,

- create a disaster recovery plan, and

- audit and update the procedures

4. Keep records for at least five years

The Australian Taxation Office (ATO) requires businesses to keep these documents for at least five (5) years:

- All GST documents

- Tax invoices

- Wage and salary records

- Records on tax returns, activity statements, fringe benefits tax returns, and contributions to employee super.

- Receipts and other records of all business transactions

- Records of other related costs of business assets

For the complete list, kindly visit ATO’s official website.

5. Back up your records

Keeping your records online keeps it safe from physical threats. However, it may still be at risk of data breaches. Creating a disaster recovery plan can strengthen the security of your sensitive data.

6. Follow ATO’s guidelines

The best record-keeping practice is to keep yourself informed of the official guidelines from the ATO.

You can visit ATO’s official website to learn more about their record-keeping guidelines.

Keeping good records is more than just a best practice—it's a necessity for any business. It helps you keep accurate and comprehensive records, which are essential to managing your cash flow, making good business decisions, meeting your tax and regulatory obligations, and demonstrating your financial position clearly to banks and investors.

Need help in organizing your financial records? You can rely on D&V Philippines. Our accountants use the latest cloud accounting software and follow record-keeping best practices. Contact us at marketing@dvphilippines.com for more information. You can also download our whitepaper, Finding the Right Talents: D&V Philippines’ Solutions to Modern Accounting Firms, to learn more about our services.