Upskilling Your Workforce: 5 Tips for Accounting Firms

Employers from the financial, professional, and business services (FPBS) sectors across the UK are facing skills shortages. Fortunately, upskilling your workforce and improving your hiring strategies can help you deal with it.

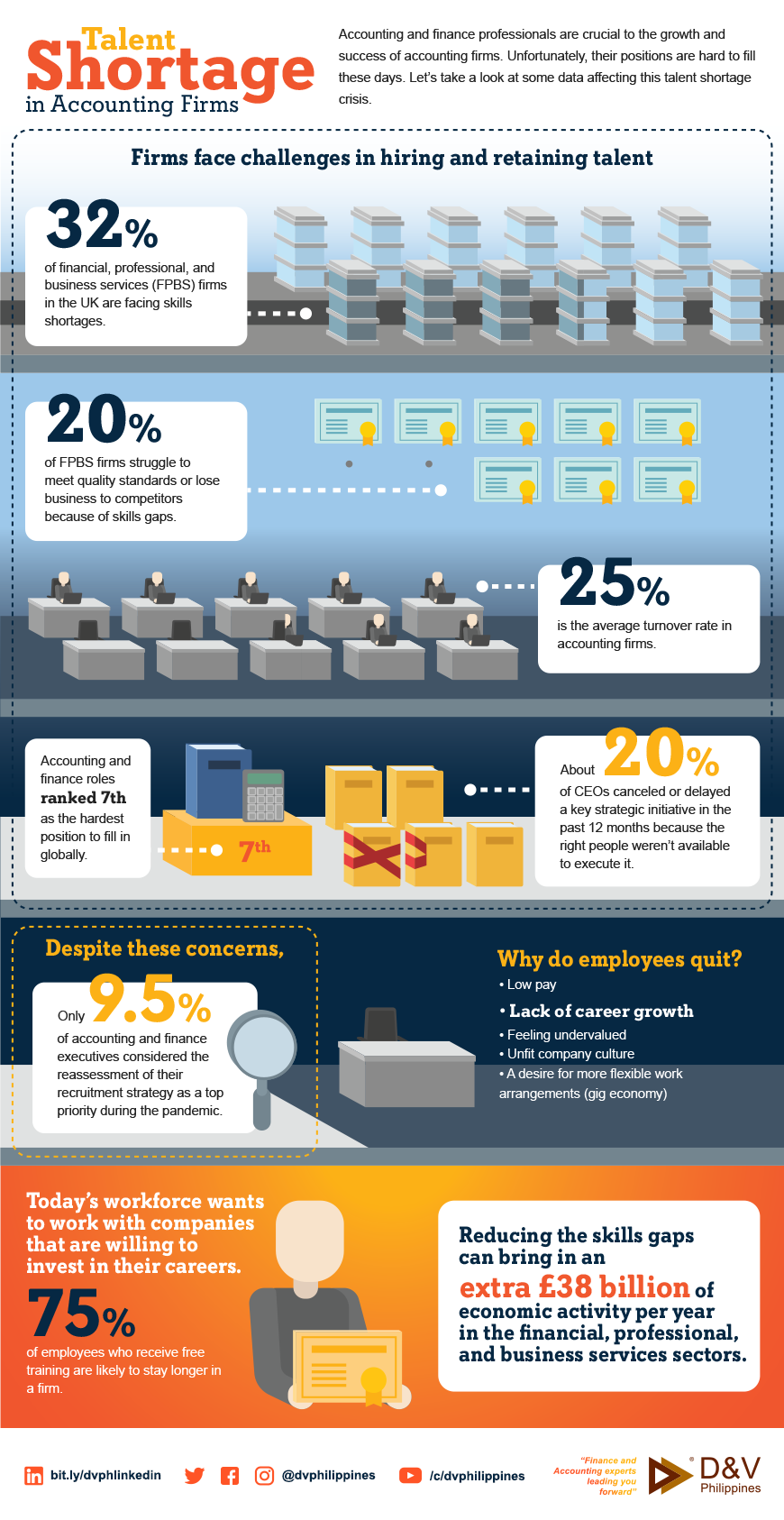

The talent shortage in accounting firms

Skills gaps can delay the growth of your firm. Among its effects, according to a report published by the Professional and Business Services Council (PBSC) and Financial Services Skills Commission (FSSC), include:

- Increased workload for your staff, which in turn, can negatively affect their wellbeing

- Higher operating costs

- Difficulties to meet quality standards

- Losing business to competitors

- Delayed projects or initiatives

Such problems occur because of the acceleration of automation and digitisation, the report added. Moreover, the expectations of today’s top talents are also changing. They’re no longer driven by salary alone. Instead, they want to work with companies that can help them grow in their careers. Without growth, resigning becomes a practical option.

To better understand the talent shortage crisis in accounting firms, take a look at the infographic below, then read the upskilling tips once you're done with this infographic.

How to upskill your accounting team

Upskilling your workforce helps you resolve skills gaps in your accounting firm and motivates your employees to work longer with you. It’s also a great way to attract more high-quality talents.

So how do you create an effective upskilling program? Here are some activities you can try.

-

Update your training and development programs

The main point of upskilling your workforce is to future-proof your firm. To remain competitive, you must keep up with the recent regulatory changes in accounting and advancements in technology. Your team must be updated with the latest industry skills and trends.

Consider these best practices to ensure you’ll come up with programs that will benefit both you and your staff:

- Identify skills gaps in your firm.

- Research about the other skills you’ll need in the future.

- Know what your competitors are doing and figure out how you can develop better training opportunities from what they currently offer. By doing so, you’re reducing the risks of losing more talents to your competitors.

- Ask your employees about the skills and knowledge they want to learn. Empower them to create their personal development plans.

- Understand the different learning styles of your employees, and find a way how you can accommodate them.

- Align your upskilling programs with your goals.

You must also remember that upskilling is an ongoing process so make it a habit to update your training programs regularly.

-

Provide training relevant to digital transformation

A digital transformation initiative is no longer an option but a key requirement to remain relevant in your industry.

As mentioned earlier, automation and digitisation are the top reasons for the skills shortage in accounting firms. Artificial intelligence is taking over repetitive accounting tasks. And from being number-crunchers, accountants must learn digital skills to work effectively with machines.

The Association of Chartered Certified Accountants (ACCA) surveyed 4,264 accountancy and finance professionals to find out the digital skills they think they’ll need in the next three to five years. The results are as follows:

- Data analytics (72%)

- Spreadsheeting (54%)

- Project management (43%)

- Digital transformation/strategy (40%)

- Artificial intelligence/machine learning (37%)

- Data structures (37%)

- Data governance (36%)

- Cybersecurity (35%)

- Future impact of applications (30%)

- Coding (26%)

- Programme management (24%)

- Current impact of applications (20%)

- Target operating model (18%)

- Robotics (17%)

To keep up with the technological changes, you may want to consider training your employees with these skills.

-

Promote mentoring programs

A mentoring program works by letting an experienced employee (mentor) work with a new employee (mentee). It benefits both the mentor and the mentee.

Employees who receive mentoring can learn a new skill faster and they also feel more satisfied with their jobs. Mentors, on the other hand, can use this opportunity to brush up on their skills and leadership abilities. In other words, it encourages knowledge and skills sharing between the two parties.

A senior accountant who teaches a junior associate about the new tax regulations in the U.K., for instance, will be driven to learn more about it to share valuable insights. Meanwhile, the junior associate, who is more technologically savvy, can also share some information about the new tools and software they can use to improve their work. It’s a win-win situation for everyone, especially for you as an executive.

The good news is it costs you almost nothing to implement.

When you foster a mentorship culture, you are also paving the way for lifelong learning in your company.

-

Explore microlearning

Typically, accountants are a busy bunch of people. Despite your good intentions, offering several, lengthy training sessions may not work for them. To make your upskilling initiatives sustainable in the long run, divide your training into bite-sized sessions (also known as microlearning).

Microlearning improves focus and supports long-term knowledge retention by up to 80%, research revealed. It’s usually in the form of a 5 to 10-minute tutorial video that delivers precise information about a certain topic.

A single course may take longer to finish compared to other strategies, but it’s okay. After all, upskilling is an ongoing process. As long as technology evolves and regulations continue to change, knowledge improvement in the workplace will always be a trend.

-

Offer financial aid

Not all knowledge and skills can be learned through training sessions. If your staff members show interest in taking certification courses to expand their accounting knowledge, do your best to support them.

If you have the means to do so, consider offering financial assistance or reimbursements. It will cost you some money, yes, but keep in mind the ROI you can get by supporting your employees in their learning endeavours.

Upskilling is a trial and error process

Skills development requires practice. Lots of it. You can’t expect your accounting team to learn a new skill instantly. Or else, you’ll only feel frustrated. But even if they can’t get it perfectly the first time or even after the tenth time, it’s okay.

Your training sessions must feel like a safe place where your employees can freely try out new skills, make mistakes, receive helpful feedback, and do everything all over again until they can master the skill.

Remember the first time you’ve balanced books or try out a new skill? It’s challenging, isn’t it? But over time, as you do it repeatedly, you become better at it, if not perfect. That’s how it works, so take your time and be more patient with your staff to reap the benefits of upskilling.

Also, make sure to provide practical training where they can test out what they’ve learned using real-life situations. Employees learn better through experience and timely feedback because they can’t know where they fall short if you won’t provide it to them. It’s also your chance to catch the effectiveness and weaknesses of your training program. In the end, you’re also learning.

But of course, upskilling alone isn’t enough to attract and retain the best employees.

As the founder of Virgin Group Richard Branson puts it, “Train people well enough so they can leave; treat them well enough, so they don't want to.”

How do you manage the skills shortages in your firm? Take upskilling seriously to get the best people onboard your team. You can also try outsourcing if you need immediate accounting support.

We, at D&V Philippines, can help you build a dedicated accounting team to support your growing needs. Contact us today for more information. You can also download our guide, Finding the Right Talents: D&V Philippines Solutions for Modern Accounting Firms, to discover the F&A services we have for you.