The Families First Coronavirus Response Act: What You Need to Know

In response to the ongoing economic impacts of the Coronavirus pandemic, the US Congress signed into law the Families First Coronavirus Response Act or FFCRA on March 18, 2020.

The FFCRA takes effect on April 1, 2020, and expires on December 31, 2020. Any leaves taken within this period are covered by FFCRA’s provisions.

For some employees who have been called back to work amid the COVID-19 pandemic and are reluctant to go back to the office due to COVID-related concerns, the FFCRA can lend some employee paid leave rights that they can avail.

We gathered some of the questions and answers about the FFCRA to help you guide your clients in understanding their obligations as employers.

Q: Which businesses are covered by the FFCRA?

A: Private employers that have fewer than 500 employees in the United States, the District of Columbia, or any other US territory are covered. Businesses with more than 500 employees are not affected.

Q: What changes do I have to make to my company’s leave policies?

A: Employers have to amend and expand their PTO and Family and Medical Leave Act (FMLA) policies to include their new obligations under the FFCRA.

Q: Will employers receive a tax credit for paid sick leaves that they will be providing?

Yes. Since the ongoing COVID-19 pandemic warranted a declaration of a national emergency under the Stafford Act, employers can provide assistance to their employees tax-free. (Refer to Section 139 of the Internal Revenue Code.)

Q: Who is eligible for the benefits of the expanded FMLA leaves under the Emergency Family and Medical Leave Act?

A: All full-time and part-time employees who have been “unable to work (or telework) due to a need for leave to care for the son or daughter under 18 years of age of such employee if the school or place of care has been closed, or the child care provider of such son or daughter is unavailable, due to a public health emergency.” (Henceforth, this will be referred to as the COVID-19 Qualifying FMLA Leave.)

Q: I have recently decided to reduce work shifts due to a lack of work. Do I still have to provide emergency paid sick leave or paid FMLA leave for my employees?

A: Neither emergency paid sick leave nor paid FMLA leave will apply as they are available only to employees who are not able to work due to circumstances related to the COVID-19 pandemic.

Q: How many weeks of COVID-19 Qualifying FMLA Leave do employers have to provide? Does it have to be paid?

A: Employees are eligible for up to 12 weeks of COVID-19 Qualifying FMLA Leave. The first 2 weeks will not be paid; however, an employee may opt to use any Sick Leaves or any unused time off credits provided for by their company FMLA policy. For the succeeding 10 weeks, the employer has to pay 2/3 of the employee’s regular rate for the total number of hours that they would have rendered for work. The paid leave will not exceed $200 per day and $10,000 in total per employee.

Nevertheless, an employee’s FMLA leave may not exceed 12 weeks in any 12-month period used by the employer to calculate the total allowable leave credits for the year. That is, if an employee has already used up a fraction of their FMLA leave entitlements for any applicable 12-month period, their COVID-19 Qualifying FMLA Leave will be reduced.

Q: Are employees on leave for reasons other than a COVID-19 Qualifying FMLA leave have to be paid the 2/3 payment requirement?

A: No; only qualified leave of absences are eligible for the 2/3 payment requirement.

Learn More about the FFCRA

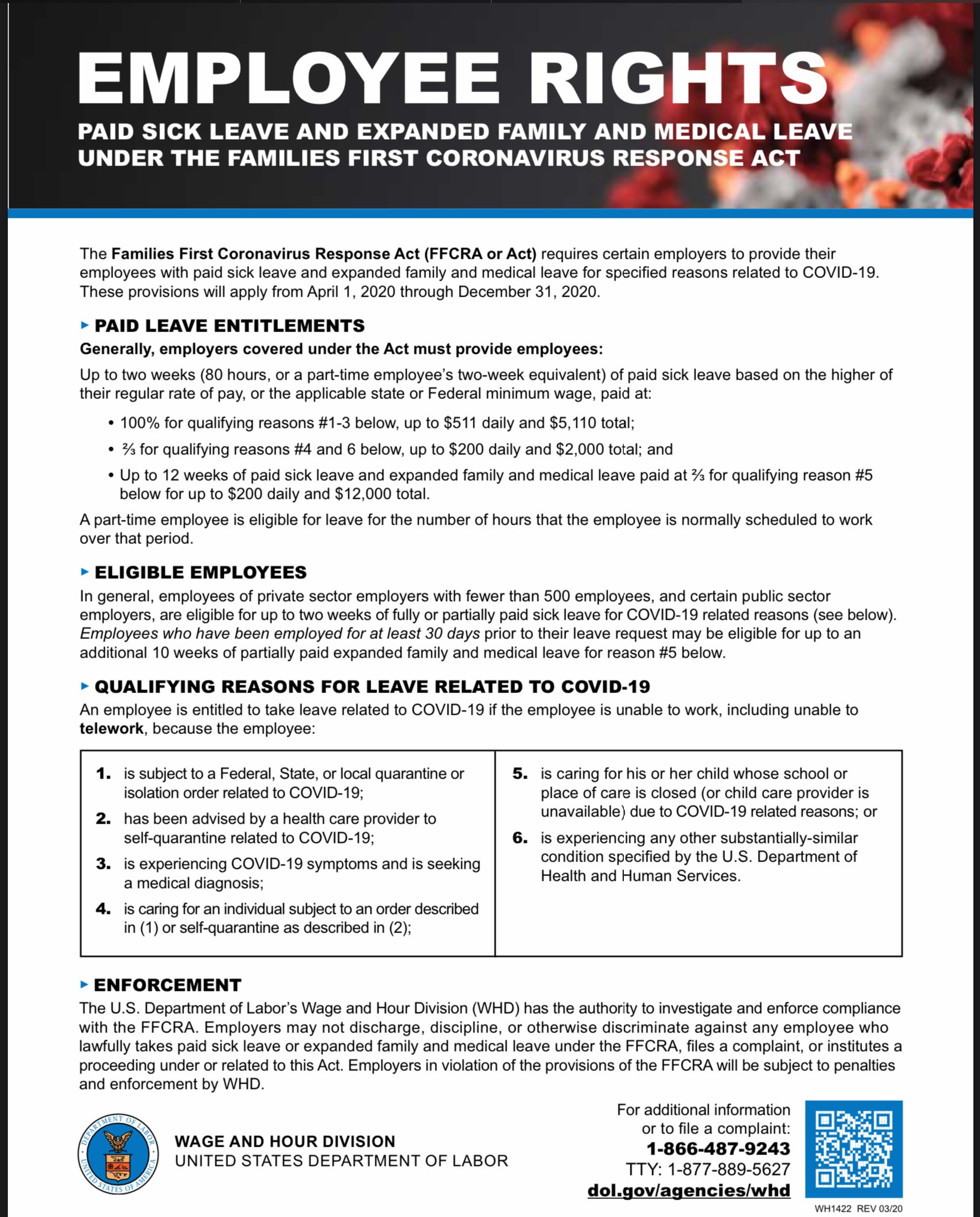

For a summary of the employee paid leave rights provided for in the Expanded Family and Medical Leave under the FFCRA, refer to the image from DOL below.

The US Department of Labor has issued some guidelines on how American workers and employers can benefit from the FFCRA. You can read a more comprehensive list of Frequently Asked Questions here.

Read Next: Government Support for Small Businesses During the COVID-19 Pandemic

Get On-Demand Support for Your Firm

If you’re looking for a cost-effective way to manage your headcount requirements this year, consider outsourcing. At D&V Philippines, we have the right accounting talent that can help meet your requirements.

Access this infographic to learn more about D&V Philippines’ finance and accounting solutions during the COVID-19 outbreak. You can also read our free downloadable guide, D&V Philippines' Seasonal Audit Support for US Audit Firms, to learn how we can help you achieve your productivity targets this season.

Contact us to discover how your firm can benefit from audit support and accounting outsourcing.

The information contained in this blog article is intended for generalized informational and educational purposes only. This does not constitute professional advice on any subject matter. This article does NOT serve as a substitute for professional and legal advice.