Business Bookkeeping Basics: Accounting for Your E-Commerce Business

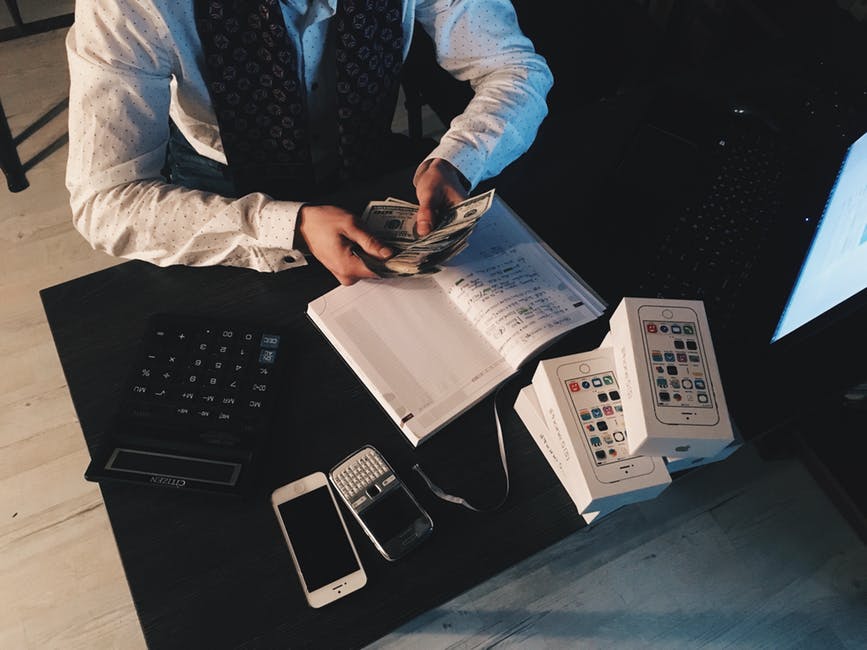

Putting up an e-commerce business is an exciting endeavor. Whether you’re a first-time business owner or an experienced entrepreneur, running your own e-commerce store can be a daunting challenge, especially if you are not familiar with e-commerce business bookkeeping.

Many first-time entrepreneurs consider small business bookkeeping to be a headache, but it’s a necessity. If you want to grow your business, it’s crucial that you have a good understanding of your business’ day-to-day performance.

Even if you choose to outsource your bookkeeping, you should still have a good understanding of how this task is done. This way, you can better understand your accountant and what their reports mean for your business.

Basic Accounting for E-Commerce Business

Here are some business bookkeeping basics from marketer and entrepreneur Neil Patel that you need to know in order to understand how your e-commerce store is doing.

1. Find the Right Accounting Software for Your Needs

You don’t have to give yourself a headache by trying to manage everything using spreadsheets. Automating your bookkeeping will help you keep your financial records with much less hassle.

There are many brands in the market, such as QuickBooks, Xero, or Freshbooks. Most of the accounting software available today have free trials, so if you’re still looking for the best accounting system that suits your business, you can give that a go. If possible, find a tool that will not just create invoices or generate reports; find one that will help you track sales and monitor your inventory.

2. Track Your Sales and Profit

Tracking your cash flow is crucial in maintaining your online business. Basically, you have to be aware if you are making more money than you are investing, and that won’t be possible if you don’t have a clear picture of how much money is coming in and going out.

3. Keep Receipts

Make sure to create a system of organizing all your receipts and invoices. These documents should be easily accessible, so work up a plan that will let you have clear visibility on how these are stored. Don’t forget to also create a label or folder for pertinent emails that get into your inbox.

4. Monitor Your Inventory

Another thing that you should be tracking is your inventory, which includes the product that you’re selling as well as the raw materials that you need to produce your product. Inventory is money, and whatever product that’s sitting in your warehouse or store can spell probable losses in the future if there’s a sudden drop in your product’s worth.

5. Determine What Your Cost of Goods Sold Is

Don’t let the term faze you: the cost of goods sold is basically just the total expense incurred for every product or service that you sell. This covers how much the inventory is sold plus the cost of producing that product or service.

Learn more about how to calculate your average cost of goods sold, as well as how to compute for other fees in this guide by Shopify.

6. Calculate How Much You Need to Break Even

Once you know how much your product or service costs, next is to find out how much your other expenses are costing you. These expenses usually include rent, utilities, property tax, loan amortization, insurance, and other expenses related to office operations such as salaries.

These are your fixed expenses; that is, it’s something that you have to pay for month after month regardless of the sales volume that you make.

Next, you should determine how much is you need to break even. The break-even amount is how much you have to make every month to cover for all the costs of your production and operations. Use this calculator to compute for your break-even point.

7. Monitor Your Sales and Profits Before Tax

7. Monitor Your Sales and Profits Before Tax

Now that you know how much your cost of goods sold and your fixed expenses are, it’s time to learn how to compute for your earnings before tax. There are many accounting rules on how to calculate for your revenue. We recommend that you leave this to the experts around tax season so that you can expend more energy in managing your sales.

Conclusion

This list is by no means exhaustive. There are many other accounting rules that can save you money once the tax season rolls in. If you’re planning to get investors or apply for a loan to expand your business in the future, you will also have to learn about standards on how to report your financial performance.

You don’t need to get caught up in all these rules, though. Don’t let it detract you from the task of managing the day-to-day operations of your e-commerce business, either. There are always accounting professionals who can help you with the business bookkeeping basics and more.

This article was first posted 22 January 2019 and edited 26 October 2020.