3 Financial Statements Every Business Should Have

When you manage a business, your lifeline is your business’ finances, which is why businesses are responsible for always being on top of their books. Having a business means you need to be constantly aware of your numbers and analytics. With this in mind, having a full grasp of your business finances is important in ensuring efficient cash flow and business optimization as it lets you know where exactly you stand and what steps you need to take.

So how do you start tinkering with your business assets without putting your capital at risk? Understanding the basics of a financial statement is a good jumpstart.

Read: Financial Planning Steps for Small Businesses

Importance of Financial Statements

Financial statements are records that reflect your financial activities and provide a forecast of your cash flow. More than anything else, your financial statements also guide you in making sound business decisions.

Types of Financial Statements

The three most basic financial statements that are vital for businesses are: balance sheets, income statements and cash flow statements.

Balance sheets

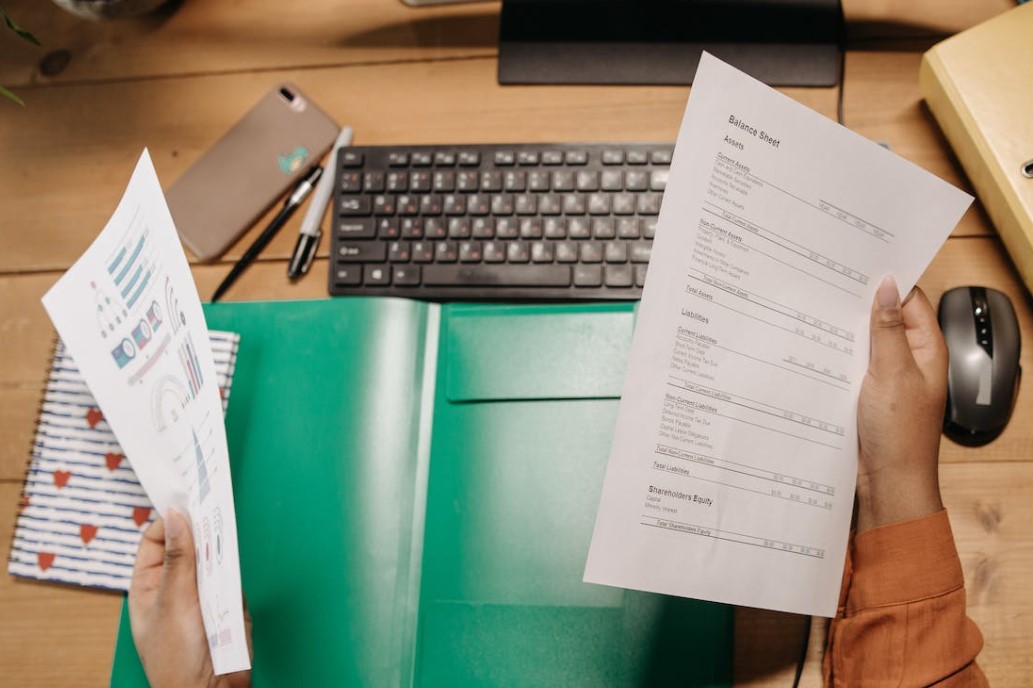

Often referred to as the balance sheet, this type of financial statement provides a summary of your SME’s assets liabilities and shareholders’ equity.

Why it is important: A balance sheet is essential because it presents the bigger picture of what your business owns, what it owes and which percentage of your assets and liabilities are maintained by your shareholders.

Income statements

Do you know how much your business is earning? How about its losses, are you aware of that, too? The best way to find out is to be familiar with your statement of comprehensive income, otherwise known as the income statement.

Why it is important: An income statement shows the results of business operations over a period through a calculation of your actual net profit.

Cash flow statements

Are you tracking the movement of money in your business? You should. Find out where your cash inflows are coming from and where it was spent by reviewing your cash flow statement.

Why it is important: Your ability to pay a loan is determined by the records in your statement of cash flows. Cash flow statements provide a historical background on the income generation and spending activities of your business. This is vital when asking for a bank loan or collaborating with investors.

Once you get the hang of financial statements, you can collaborate more easily with your accounting team to know how you can use your financial statements to decide on your business’ steps such as optimization, development and even expansion! They will be able to translate your financial data for you while you pay close attention to your company's next steps.

Read Next: What Fund Management can do for your Company

Know what you can do with your finances today!

We have a wide expertise in handling the numbers of businesses across various industries and broad experience in using top-of-the-line software to better handle your finances. Contact us today and we will help you find the right fund administration strategy for your needs.

Download our Premium CFO Solutions today and know how we can be your reliable outsourcing partner.

This post was first published on 21 Aug 2014 and edited 26 May 2023. Edited by: Aly Tagamolila