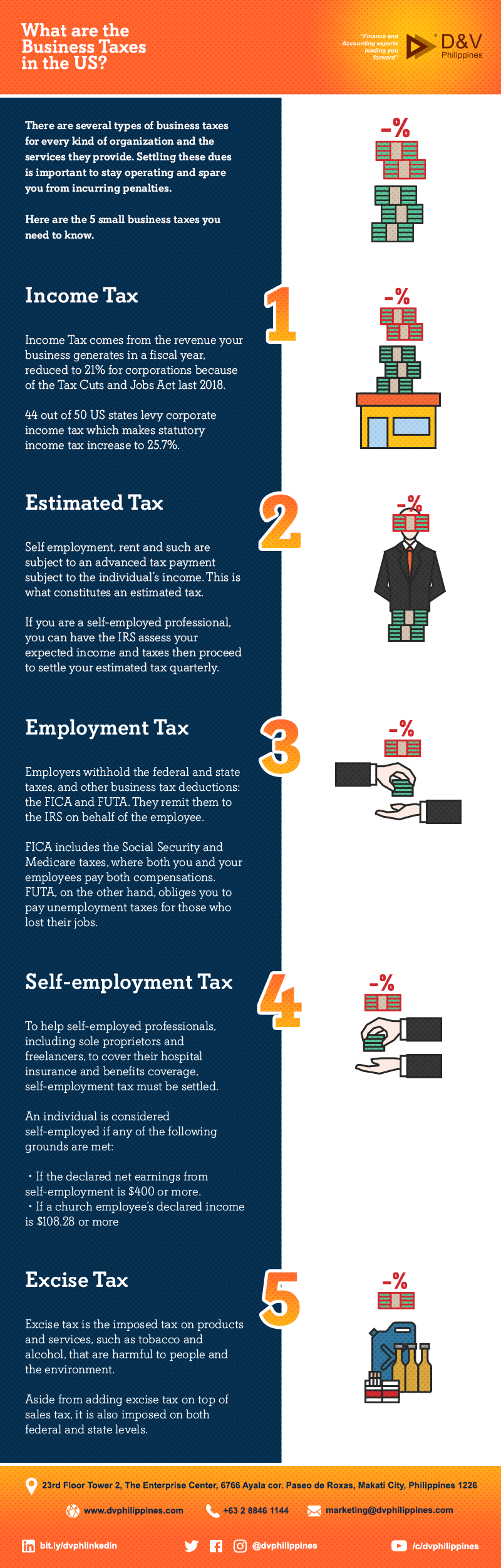

What are the Business Taxes in the US?

There are several types of business taxes for every kind of organization and the services they provide. Settling these dues is important to stay operating and spare you from incurring penalties.

Here are the 5 small business taxes you need to know.

1. Income Tax

Income Tax comes from the revenue your business generates in a fiscal year, reduced to 21% for corporations because of the Tax Cuts and Jobs Act last 2018.

44 out of 50 US states levy corporate income tax which makes statutory income tax increase to 25.7%.

2. Estimated Tax

Self employment, rent and such are subject to an advanced tax payment subject to the individual’s income. This is what constitutes an estimated tax.

If you are a self-employed professional, you can have the IRS assess your expected income and taxes then proceed to settle your estimated tax quarterly.

3. Employment Tax

Employers withhold the federal and state taxes, and other business tax deductions: the FICA and FUTA. They remit them to the IRS on behalf of the employee.

FICA includes the Social Security and Medicare taxes, where both you and your employees pay both compensations. FUTA, on the other hand, obliges you to pay unemployment taxes for those who lost their jobs.

4. Self-employment Tax

To help self-employed professionals, including sole proprietors and freelancers, to cover their hospital insurance and benefits coverage, self-employment tax must be settled.

An individual is considered self-employed if any of the following grounds are met:

- If the declared net earnings from self-employment is $400 or more.

- If a church employee’s declared income is $108.28 or more

5. Excise Tax

Excise tax is the imposed tax on products and services, such as tobacco and alcohol, that are harmful to people and the environment.

Aside from adding excise tax on top of sales tax, it is also imposed on both federal and state levels.

Understanding the different types of business taxes not only helps you to comply with the government rules, but increases your credibility to potential investors as an organization.

For small business tax services, look no further than D&V Philippines. We'll help you get your numbers in order so you won't have to worry when the deadline arrives.

Thinking of taking the next step? Read our guide, Outsourcing: How to Make it Work, to find out how you can maximize your outsourcing partnership with us.