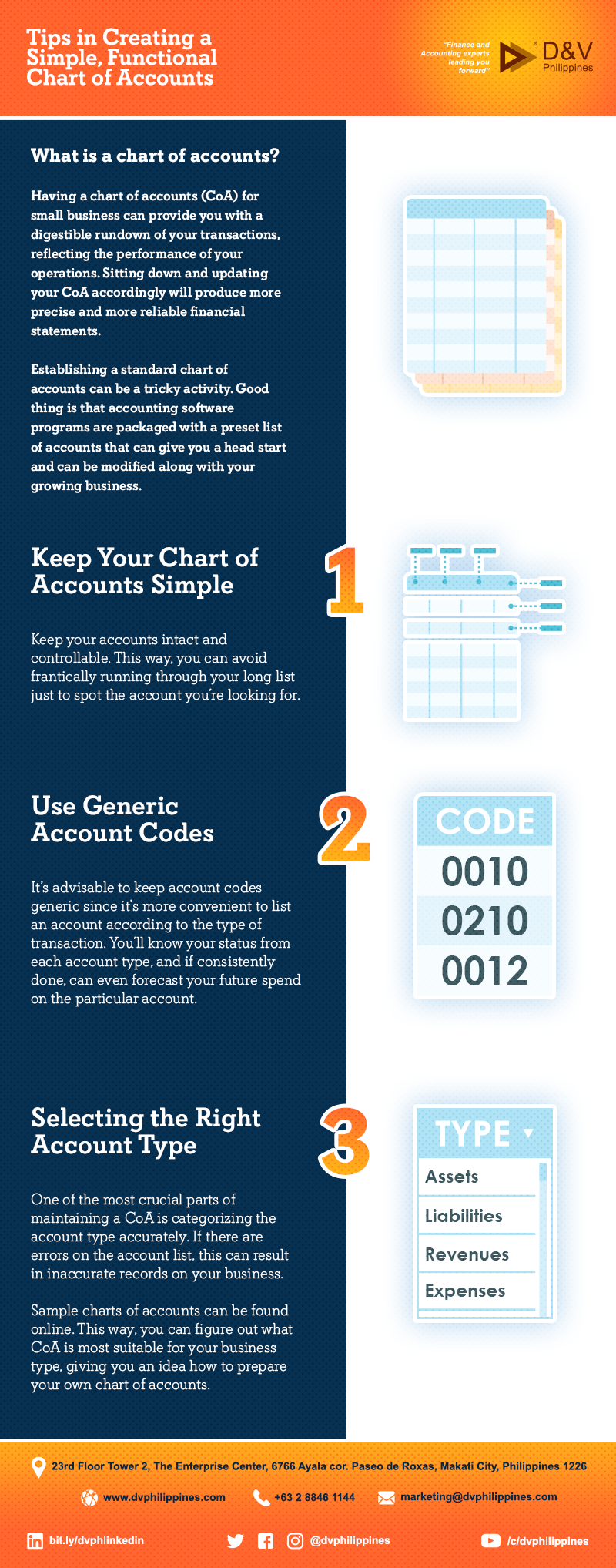

Tips in Creating a Simple, Functional Chart of Accounts

What is a chart of accounts?

Having a chart of accounts (CoA) for small business can provide you with a digestible rundown of your transactions, reflecting the performance of your operations. Sitting down and updating your CoA accordingly will produce more precise and more reliable financial statements.

Establishing a standard chart of accounts can be a tricky activity. Good thing is that accounting software programs are packaged with a preset list of accounts that can give you a head start and can be modified along with your growing business.

Keep Your Chart of Accounts Simple

Keep your accounts intact and controllable. This way, you can avoid frantically running through your long list just to spot the account you’re looking for.

Use Generic Account Codes

It’s advisable to keep account codes generic since it’s more convenient to list an account according to the type of transaction. You’ll know your status from each account type, and if consistently done, can even forecast your future spend on the particular account.

Selecting the Right Account Type

One of the most crucial parts of maintaining a CoA is categorizing the account type accurately. If there are errors on the account list, this can result in inaccurate records on your business.

Knowing what is a chart of accounts can contribute to your financial stability and your small business. With proper tracking of expenditures, you can learn how to best manage your finances as your business scales through the years.