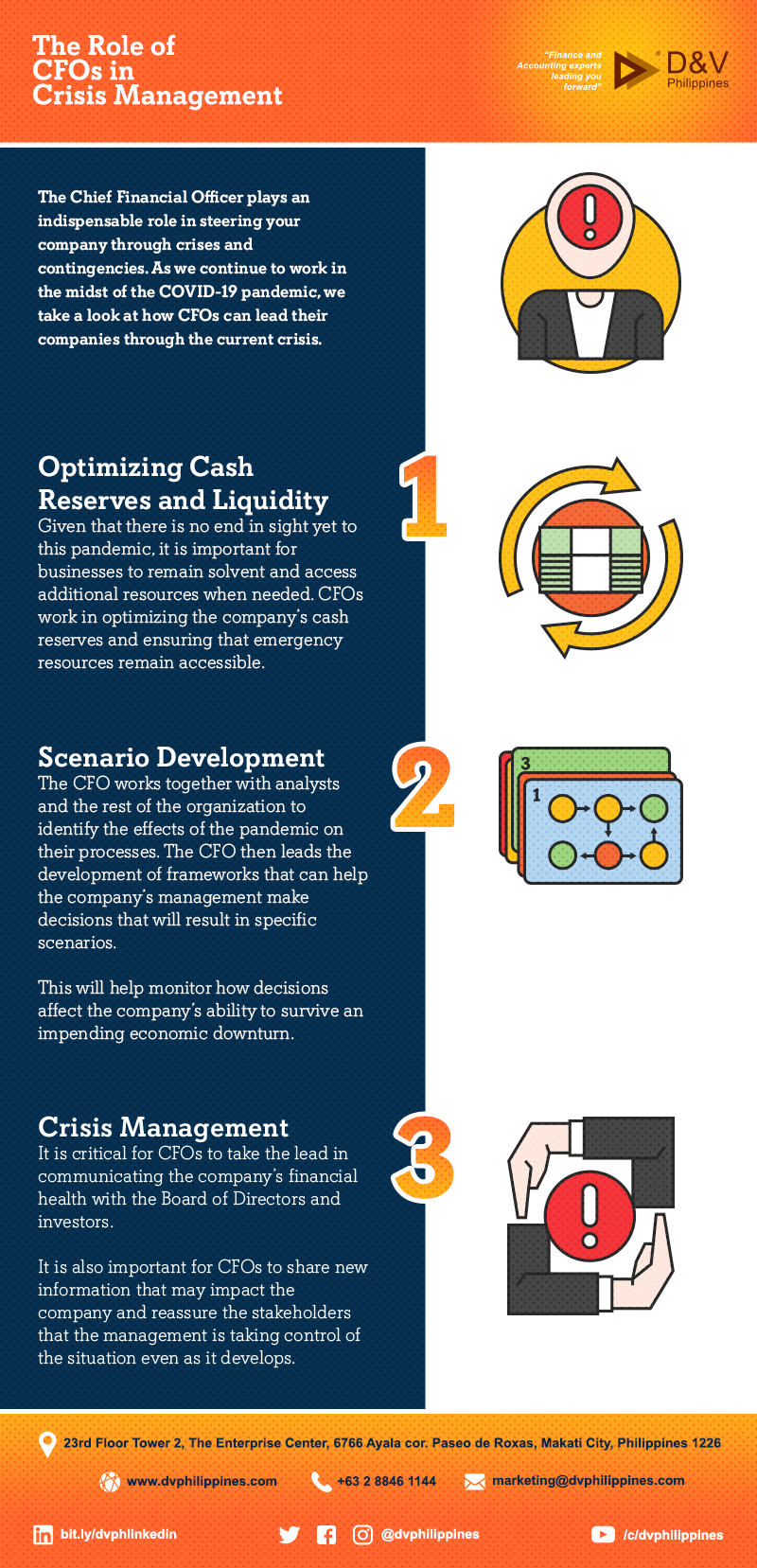

The Role of CFOs in Crisis Management

The Chief Financial Officer plays an indispensable role in steering your company through crises and contingencies. As we continue to work in the midst of the COVID-19 pandemic, we take a look at how CFOs can lead their companies through the current crisis.

1. Optimizing Cash Reserves and Liquidity

Given that there is no end in sight yet to this pandemic, it is important for businesses to remain solvent and access additional resources when needed. CFOs work in optimizing the company’s cash reserves and ensuring that emergency resources remain accessible.

2. Scenario Development

The CFO works together with analysts and the rest of the organization to identify the effects of the pandemic on their processes. The CFO then leads the development of frameworks that can help the company’s management make decisions that will result in specific scenarios.

This will help monitor how decisions affect the company’s ability to survive an impending economic downturn.

3. Crisis Management

It is critical for CFOs to take the lead in communicating the company’s financial health with the Board of Directors and investors.

It is also important for CFOs to share new information that may impact the company and reassure the stakeholders that the management is taking control of the situation even as it develops.

Need additional support to help your CFO manage your finance and accounting processes? Our scalable solutions are ideal to help augment your F&A team as you work in crisis management during the current pandemic. Download our Premium CFO Solutions today and learn more about our specialized CFO Services.