Xero vs. Quickbooks: Which Suits Your Business Better?

Small business cloud accounting is an emerging trend in the finance and accounting (F&A) industry, as it revolutionizes the way we do number crunching. Transferring to the cloud gives you a better visibility of your cash flow, increased productivity of your team, and automated solutions for a more efficient work flow.

How do you choose the best cloud accounting software for your business?

Looking for a software that can meet your business requirements is an extensive process. As a small business owner, you need to be circumspect in selecting a cloud program to introduce to your system, and at the same time be agile in keeping up with what the market has to offer.

Cloud-based small business accounting simplifies and standardizes our manual processes, thus saving us some time in focusing on more important tasks. With the great functionalities they offer the F&A industry, they have enticed small business owners to capitalize on this long-term investment.

QuickBooks and Xero are among the accounting software giants to offer innovative solutions to the market. They are optimized to meet the demands of your business with different approaches. Let’s find out which of the two is best suited for your company.

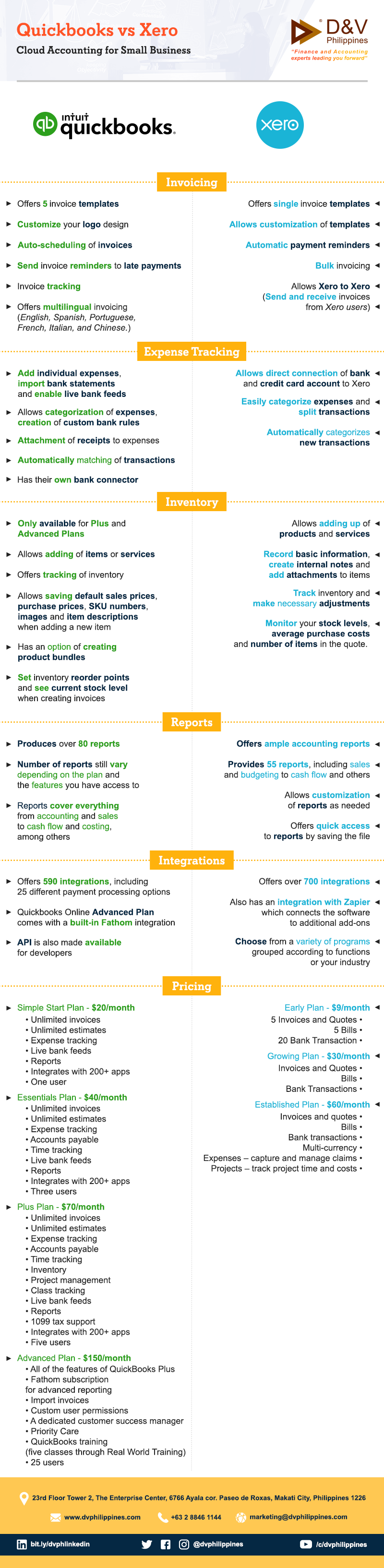

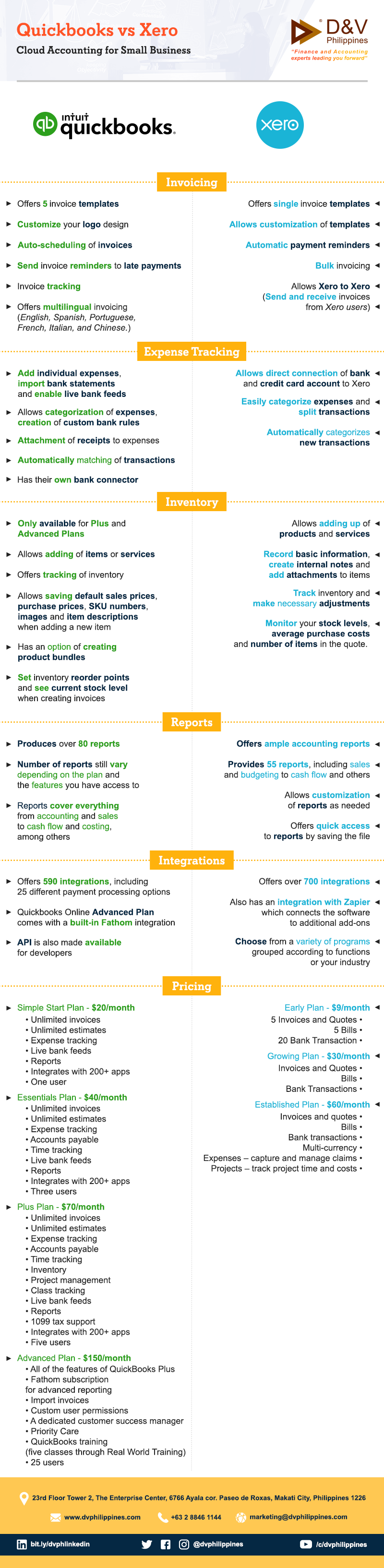

Quickbooks vs. Xero Cloud Accounting for Small Business

|

QUICKBOOKS

|

|

XERO

|

- Offers 5 invoice templates

- Customize your logo design

- Allows attachments to invoices

- Auto-scheduling of invoices

- Send invoice reminders to late payments

- Invoice tracking

- Offers multilingual invoicing (English, Spanish, Portuguese, French, Italian, and Chinese.)

|

Invoicing

|

- Offers single invoice template

- Allows customization of templates

- Automatic payment reminders

- Bulk invoicing

- Allows Xero to Xero (Send and receive invoices from Xero users)

|

- Add individual expenses, import bank statements and enable live bank feeds

- Allows categorization of expenses, creation of custom bank rules

- Attachment of receipts to expenses

- Automatically matching of transactions

- Offers new receipt capture feature

- Has their own bank connector

|

Expense Tracking

.

|

- Allows direct connection of bank and credit card account to Xero

- Easily categorize expenses and split transactions

- Automatically categorizes new transactions

|

- Only available for Plus and Advanced Plans

- Allows adding of items or services

- Offers tracking of inventory

- Allows saving default sales prices, purchase prices, SKU numbers, images and item descriptions when adding a new item

- Has an option of creating product bundles

- Set inventory reorder points and see current stock level when creating invoices.

|

Inventory

|

- Allows adding up of products and services

- Record basic information, create internal notes and add attachments to items

- Track inventory and make necessary adjustments

- Monitor your stock levels, average purchase costs and number of items in the quote.

|

- Produces over 80 reports

- Number of reports still vary depending on the plan and the features you have access to.

- Reports cover everything from accounting and sales to cash flow and costing, among others.

|

Reports

|

- Offers ample accounting reports

- Provides 55 reports, including sales and budgeting to cash flow and others.

- Allows customization of reports as needed

- Offers quick access to reports by saving the file

|

- Offers 590 integrations, including 25 different payment processing options.

- Quickbooks Online Advanced Plan comes with a built-in Fathom integration.

- API is also made available for developers.

|

Integrations

|

- Offers over 700 integrations

- Also has an integration with Zapier which connects the software to additional add-ons.

- Choose from a variety of programs grouped according to functions or your industry.

|

|

Simple Start Plan - $20/Month

- Unlimited invoices

- Unlimited estimates

- Expense tracking

- Live bank feeds

- Reports

- Integrates with 200+ apps

- One user

Essentials Plan - $40/ Month

- Unlimited invoices

- Unlimited estimates

- Expense tracking

- Accounts payable

- Time tracking

- Live bank feeds

- Reports

- Integrates with 200+ apps

- Three users

Plus Plan - $70/ Month

- Unlimited invoices

- Unlimited estimates

- Expense tracking

- Accounts payable

- Time tracking

- Inventory

- Project management

- Class tracking

- Live bank feeds

- Reports

- 1099 tax support

- Integrates with 200+ apps

- Five users

Advanced Plan - $150/Month

- All of the features of QuickBooks Plus

- Fathom subscription for advanced reporting

- Import invoices

- Custom user permissions

- A dedicated customer success manager

- Priority Care

- QuickBooks training (five classes through Real World Training)

- 25 users

|

Pricing

|

Early Plan - $9/Month

- 5 Invoices and Quotes

- 5 Bills

- 20 Bank Transaction

Growing Plan - $30/ Month

- Invoices and Quotes

- Bills

- Bank Transactions

Established Plan - $60/Month

- Invoices and quotes

- Bills

- Bank transactions

- Multi-currency

- Expenses – capture and manage claims

- Projects – track project time and costs

|

Let D&V Philippines help you with your accounting process. Get in touch with our experts today and learn how we can make the most out of your business.