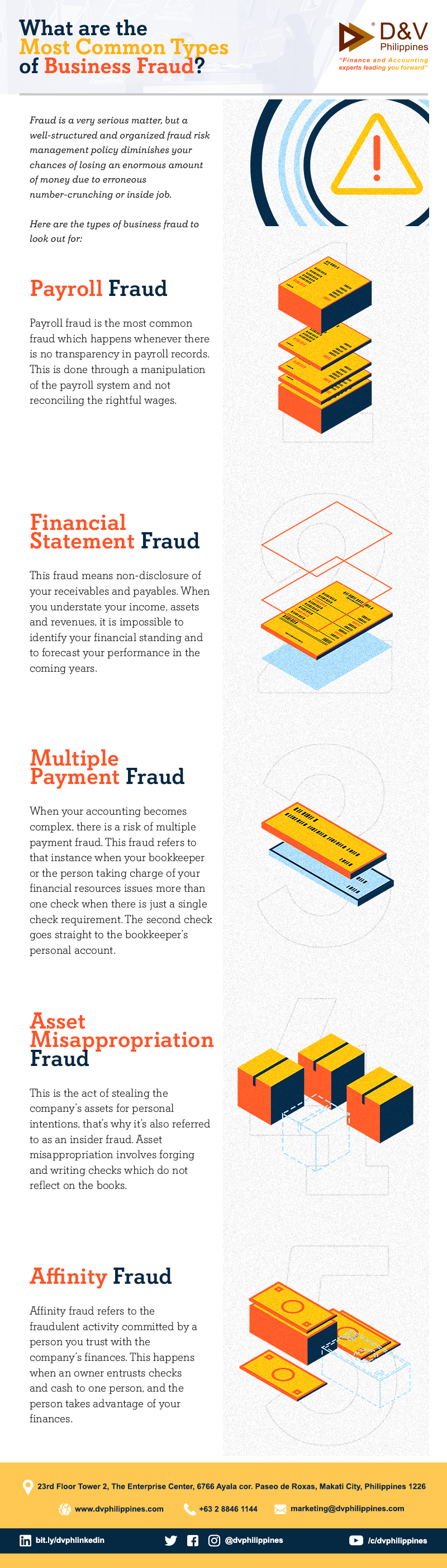

What are the Most Common Types of Business Fraud to watch out for?

Fraud is a very serious matter, but a well-structured and organized fraud risk management policy diminishes your chances of losing an enormous amount of money due to erroneous number-crunching or inside job.

Here are the types of business fraud to look out for:

Payroll Fraud

Payroll fraud is the most common fraud which happens whenever there is no transparency in payroll records. This is done through a manipulation of the payroll system and not reconciling the rightful wages.

Financial Statement Fraud

This fraud means non-disclosure of your receivables and payables. When you understate your income, assets, and revenues, it is impossible to identify your financial standing and to forecast your performance in the coming years.

Multiple Payment Fraud

When your accounting becomes complex, there is a risk of multiple payment fraud. This fraud refers to that instance when your bookkeeper or the person taking charge of your financial resources issues more than one check when there is just a single check requirement. The second check goes straight to the bookkeeper’s personal account.

Asset Misappropriation Fraud

This is the act of stealing the company’s assets for personal intentions, that’s why it’s also referred to as an insider fraud. Asset misappropriation involves forging and writing checks which do not reflect on the books.

Affinity Fraud

Affinity fraud refers to the fraudulent activity committed by a person you trust with the company’s finances. This happens when an owner entrusts checks and cash to one person, and the person takes advantage of your finances.