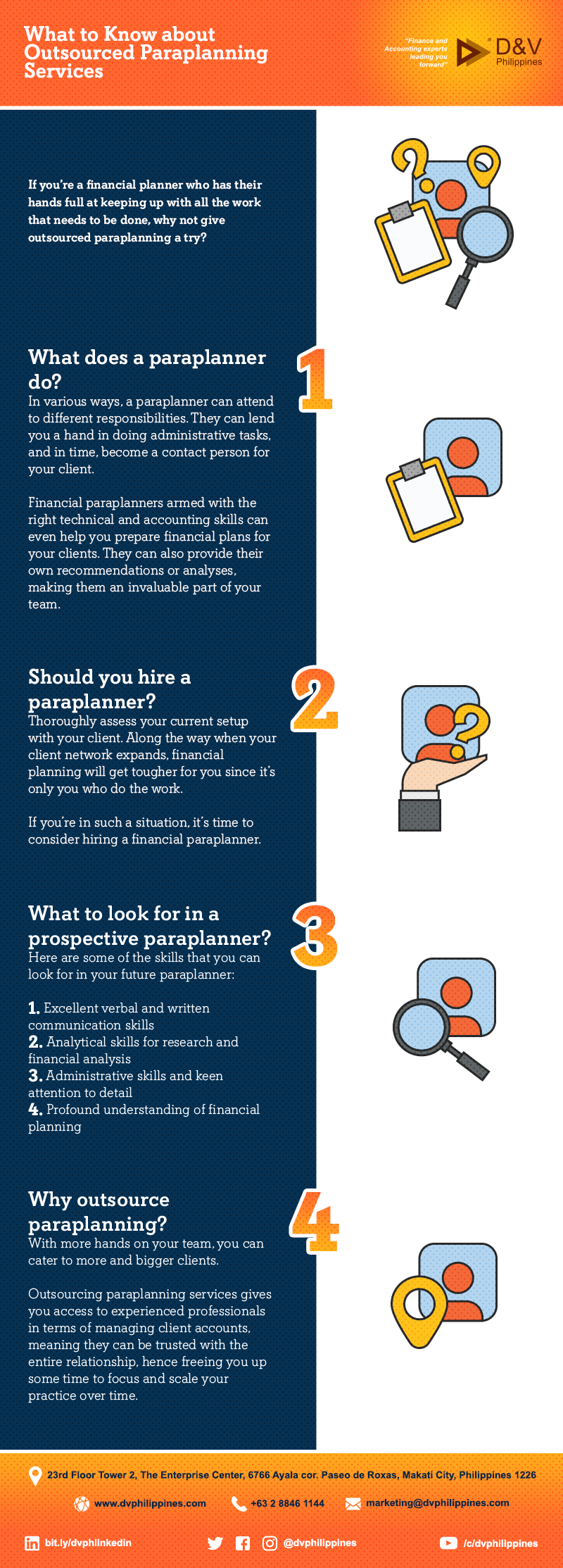

What to Know about Outsourced Paraplanning Services

If you’re a financial planner who has their hands full at keeping up with all the work that needs to be done, why not give outsourced paraplanning a try?

What does a paraplanner do?

In various ways, a paraplanner can attend to different responsibilities. They can lend you a hand in doing administrative tasks, and in time, become a contact person for your client.

Financial paraplanners armed with the right technical and accounting skills can even help you prepare financial plans for your clients. They can also provide their own recommendations or analyses, making them an invaluable part of your team.

Should you hire a paraplanner?

Thoroughly assess your current setup with your client. Along the way when your client network expands, financial planning will get tougher for you since it’s only you who do the work.

If you’re in such a situation, it’s time to consider hiring a financial paraplanner.

What to look for in a prospective paraplanner?

Here are some of the skills that you can look for in your future paraplanner:

- Excellent verbal and written communication skills

- Analytical skills for research and financial analysis

- Administrative skills and keen attention to detail

- Profound understanding of financial planning

Why outsource paraplanning?

With more hands on your team, you can cater to more and bigger clients.

Outsourcing paraplanning services gives you access to experienced professionals in terms of managing client accounts, meaning they can be trusted with the entire relationship, hence freeing you up some time to focus and scale your practice over time.

Need the right talents that best suit your business requirements? Get your copy of our whitepaper, Your Talent Sourcing Partner, to know how D&V Philippines hones our in-house talents in providing the best F&A service to our clients.