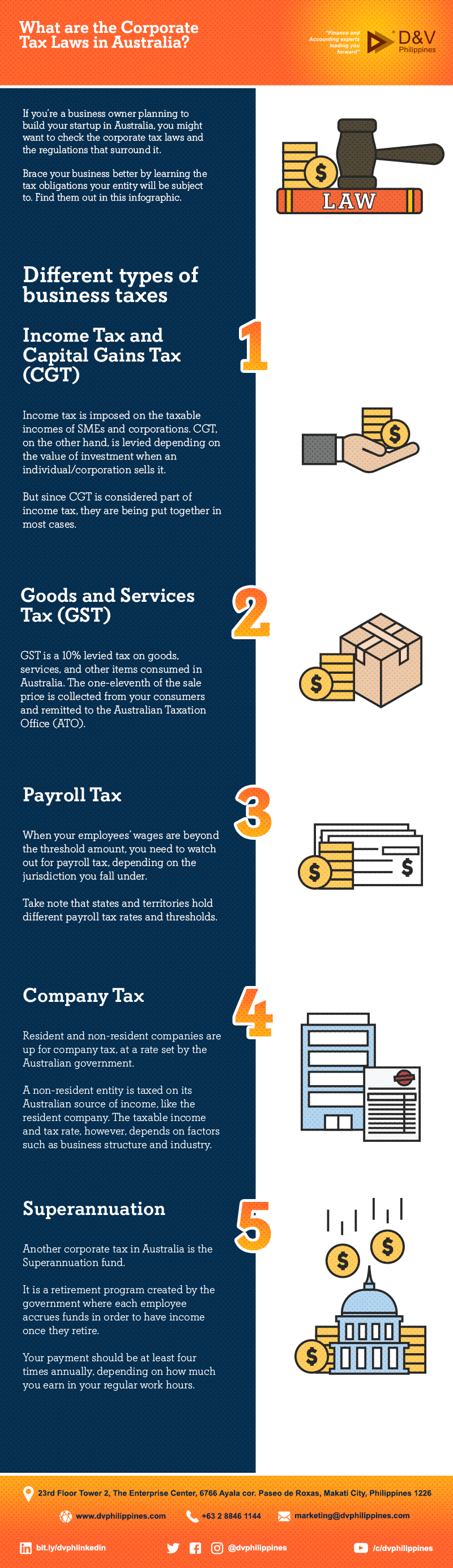

What are the Corporate Tax Laws in Australia?

If you’re a business owner planning to build your startup in Australia, you might want to check the corporate tax laws and the regulations that surround it.

Brace your business better by learning the tax obligations your entity will be subject to. Find them out in this infographic.

Different types of business taxes

1. Income Tax and Capital Gains Tax (CGT)

Income tax is imposed on the taxable incomes of SMEs and corporations. CGT, on the other hand, is levied depending on the value of investment when an individual/corporation sells it.

But since CGT is considered part of income tax, they are being put together in most cases.

2. Goods and Services Tax (GST)

GST is a 10% levied tax on goods, services, and other items consumed in Australia. The one-eleventh of the sale price is collected from your consumers and remitted to the Australian Taxation Office (ATO).

3. Payroll Tax

When your employees’ wages are beyond the threshold amount, you need to watch out for payroll tax, depending on the jurisdiction you fall under.

Take note that states and territories hold different payroll tax rates and thresholds.

4. Company Tax

Resident and non-resident companies are up for company tax, at a rate set by the Australian government.

A non-resident entity is taxed on its Australian source of income, like the resident company. The taxable income and tax rate, however, depends on factors such as business structure and industry.

5. Superannuation

Another corporate tax in Australia is the Superannuation fund.

It is a retirement program created by the government where each employee accrues funds in order to have income once they retire.

Your payment should be at least four times annually, depending on how much you earn in your regular work hours.

Knowing the business tax obligations before settling your entity in Australia will help you prepare for what will come ahead, and find out what are your dues during the course of your operations.

If you want a partner to help you in managing corporate tax laws in Australia, we’re here to help. D&V Philippines provides high-end F&A back support for accounting firms so you can make sure your finances are in the right hands. You can download our guide Finding the Right Talents: D&V Philippines’ Solutions for Modern Accounting Firms to find out how our top-notch talents can help set your entity up for better financial management.