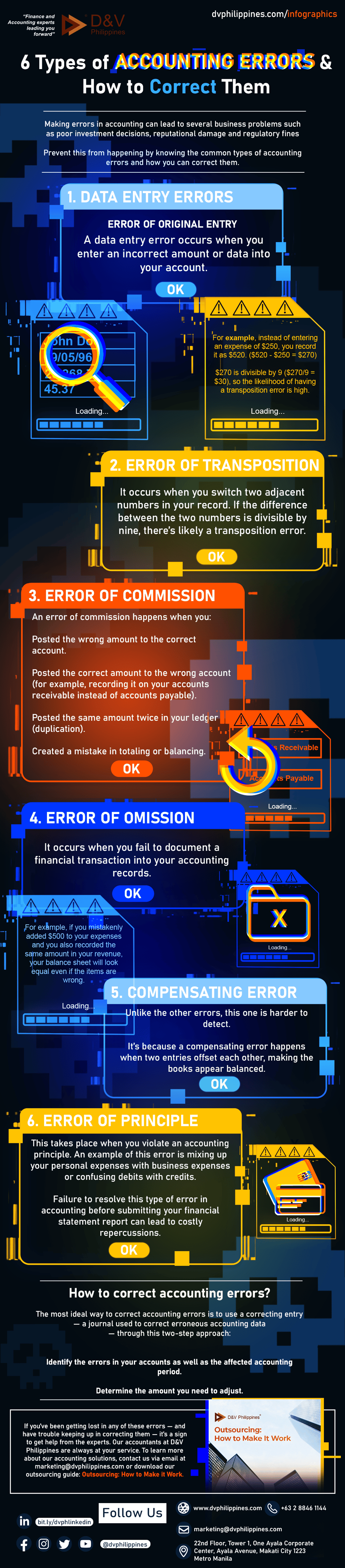

6 Types of Accounting Errors & How to Correct Them

Making errors in accounting can lead to several business problems such as poor investment decisions, reputational damage and regulatory fines.

Prevent this from happening by knowing the common types of accounting errors and how you can correct them.

1. Data entry errors (error of original entry)

A data entry error occurs when you enter an incorrect amount or data into your account.

2. Error of transposition

It occurs when you switch two adjacent numbers in your record. If the difference between the two numbers is divisible by nine, there’s likely a transposition error.

For example, instead of entering an expense of $250, you record it as $520. ($520 - $250 = $270)

$270 is divisible by 9 ($270/9 = $30), so the likelihood of having a transposition error is high.

3. Error of commission

An error of commission happens when you:

- posted the wrong amount to the correct account,

- posted the correct amount to the wrong account (for example, recording it on your accounts receivable instead of accounts payable),

- posted the same amount twice in your ledger (duplication), or

- created a mistake in totaling or balancing.

4. Error of omission

It occurs when you fail to document a financial transaction into your accounting records.

5. Compensating error

Unlike the other errors, this one is harder to detect.

It’s because a compensating error happens when two entries offset each other, making the books appear balanced.

For example, if you mistakenly added $500 to your expenses and you also recorded the same amount in your revenue, your balance sheet will look equal even if the items are wrong.

6. Error of principle

This takes place when you violate an accounting principle. An example of this error is mixing up your personal expenses with business expenses or confusing debits with credits.

Failure to resolve this type of error in accounting before submitting your financial statement report can lead to costly repercussions.

How to correct accounting errors?

The most ideal way to correct accounting errors is to use a correcting entry — a journal used to correct erroneous accounting data — through this two-step approach:

- Identify the errors in your accounts as well as the affected accounting period.

- Determine the amount you need to adjust.

If you’ve been getting lost in any of these errors — and have trouble keeping up in correcting them — it’s a sign to get help from the experts. Our accountants at D&V Philippines are always at your service. To learn more about our accounting solutions, contact us via email at marketing@dvphilippines.com or download our outsourcing guide: Outsourcing: How to Make it Work.