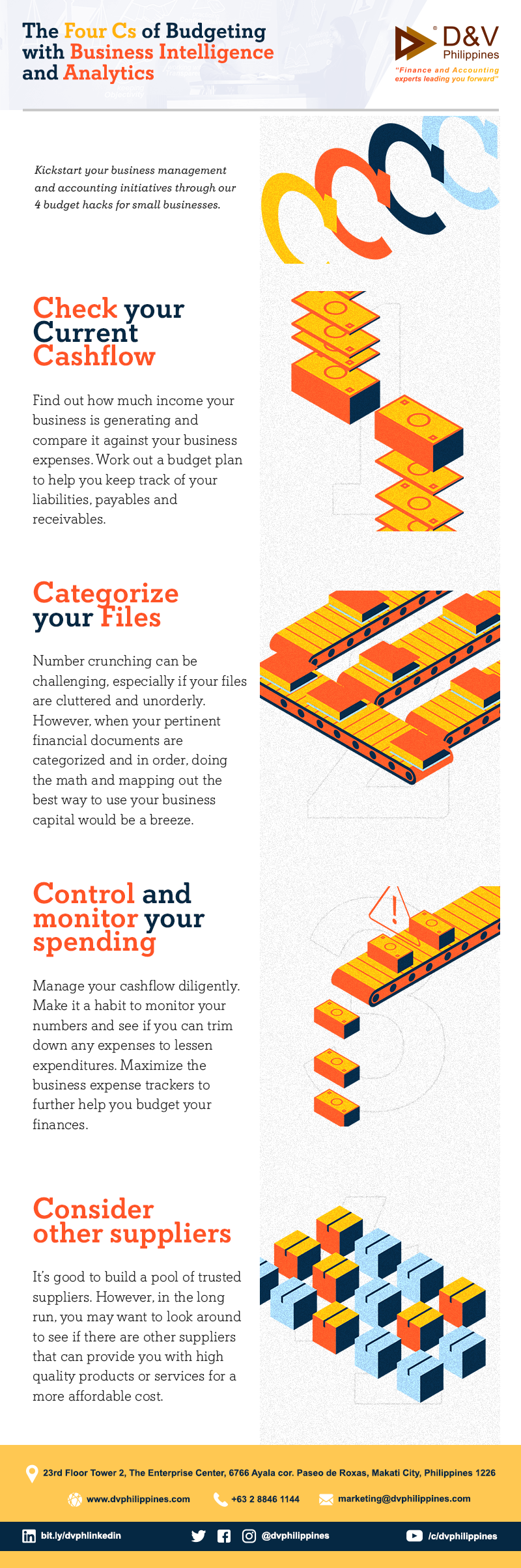

[INFOGRAPHIC] The Four C of Budgeting With Business Intelligence and Analytics

Kickstart your business management and accounting initiatives through our 4 budget hacks for small businesses.

Check your Current Cash flow

Find out how much income your business is generating and compare it against your business expenses. Work out a budget plan to help you keep track of your liabilities, payables, and receivables.

Categorize your Files

Number crunching can be challenging, especially if your files are cluttered and unorderly. However, when your pertinent financial documents are categorized and in order, doing the math and mapping out the best way to use your business capital would be a breeze.

Control and monitor your spending

Manage your cash flow diligently. Make it a habit to monitor your numbers and see if you can trim down any expenses to lessen expenditures. Maximize the business expense trackers to further help you budget your finances.

Consider other suppliers

It’s good to build a pool of trusted suppliers. However, in the long run, you may want to look around to see if there are other suppliers that can provide you with high-quality products or services for a more affordable cost.