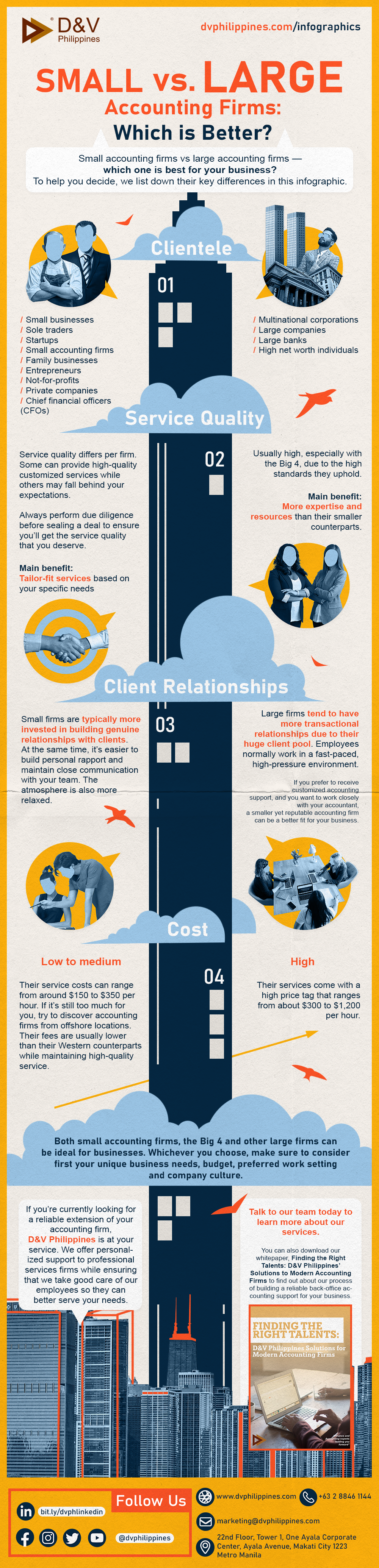

Small vs. Large Accounting Firms: Which is Better?

Small accounting firms vs large accounting firms — which one is best for your business? To help you decide, we list down their key differences in this infographic.

Clientele

Small accounting firms

- Small businesses

- Sole traders

- Startups

- Small accounting firms

- Family businesses

- Entrepreneurs

- Not-for-profits

- Private companies

- Chief financial officers (CFOs)

Large accounting firms

- Multinational corporations

- Large companies

- Large banks

- High net worth individuals

Service quality

Small accounting firms

Service quality differs per firm. Some can provide high-quality customized services while others may fall behind your expectations. Always perform due diligence before sealing a deal to ensure you’ll get the service quality that you deserve.

Main benefit: Tailor-fit services based on your specific needs

Large accounting firms

Usually high, especially with the Big 4, due to the high standards they uphold.

Main benefit: More expertise and resources than their smaller counterparts.

Client relationships

Small accounting firms

Small firms are typically more invested in building genuine relationships with clients. At the same time, it’s easier to build personal rapport and maintain close communication with your team. The atmosphere is also more relaxed.

Large accounting firms

Large firms tend to have more transactional relationships due to their huge client pool. Employees normally work in a fast-paced, high-pressure environment.

If you prefer to receive customized accounting support, and you want to work closely with your accountant, a smaller yet reputable accounting firm can be a better fit for your business.

Cost

Small accounting firms

Low to medium.

Their service costs can range from around $150 to $350 per hour. If it’s still too much for you, try to discover accounting firms from offshore locations. Their fees are usually lower than their Western counterparts while maintaining high-quality service.

Large accounting firms

High

Their services come with a high price tag that ranges from about $300 to $1,200 per hour.

Both small accounting firms, the Big 4 and other large firms can be ideal for businesses. Whichever you choose, make sure to consider first your unique business needs, budget, preferred work setting and company culture.

If you’re currently looking for a reliable extension of your accounting firm, D&V Philippines is at your service. We offer personalized support to professional services firms while ensuring that we take good care of our employees so they can better serve your needs.

Talk to our team today to learn more about our services. You can also download our whitepaper, Finding the Right Talents: D&V Philippines’ Solutions to Modern Accounting Firms to find out about our process of building a reliable back-office accounting support for your business.