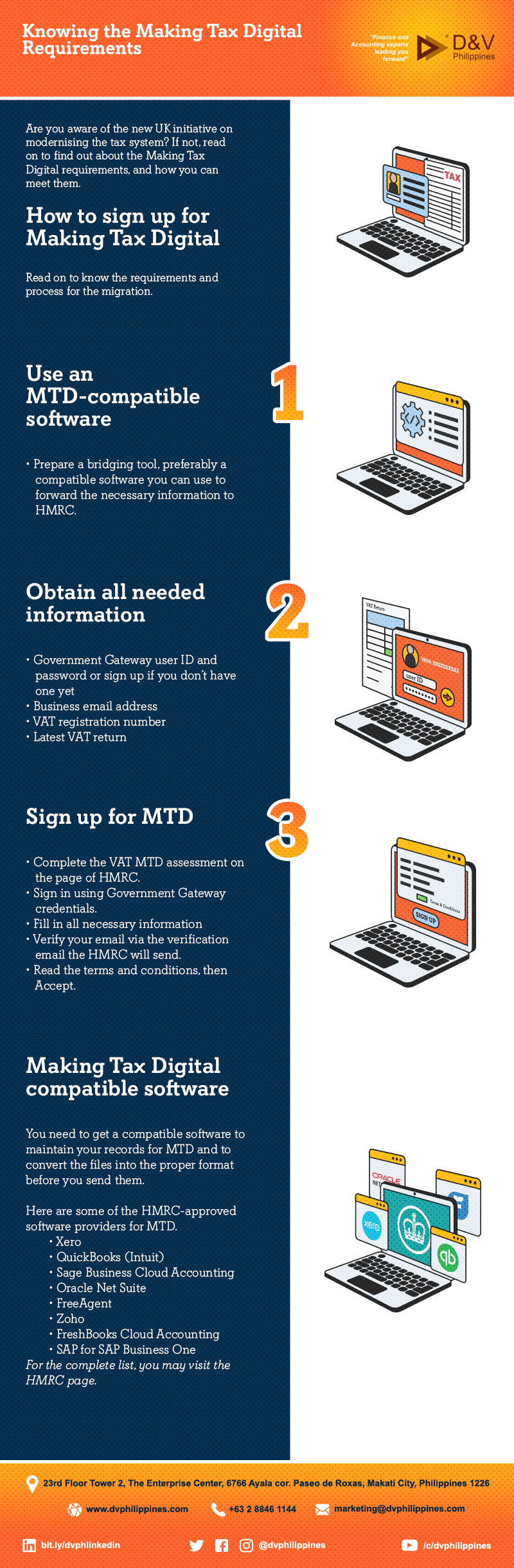

Knowing the Requirements for The UK's Making Tax Digital

Are you aware of the new UK initiative on modernising the tax system? If not, read on to find out about the Making Tax Digital requirements, and how you can meet them.

How to sign up for Making Tax Digital

Read on to know the requirements and process for the migration.

1. Use an MTD-compatible software

- Prepare a bridging tool, preferably a compatible software you can use to forward the necessary information to HMRC.

2. Obtain all needed information

- Government Gateway user ID and password or sign up if you don’t have one yet

- Business email address

- VAT registration number

- Latest VAT return

3. Sign up for MTD

- Complete the VAT MTD assessment on the page of HMRC.

- Sign in using Government Gateway credentials.

- Fill in all necessary information

- Verify your email via the verification email the HMRC will send.

- Read the terms and conditions, then Accept.

Making Tax Digital compatible software

You need to get a compatible software to maintain your records for MTD and to convert the files into the proper format before you send them.

Here are some of the HMRC-approved software providers for MTD.

- Xero

- QuickBooks (Intuit)

- Sage Business Cloud Accounting

- Oracle NetSuite

- FreeAgent

- Zoho

- FreshBooks Cloud Accounting

- SAP for SAP Business One

For the complete list, you may visit the HMRC page.

With our wide experience in using top-of-the-line accounting software, meeting the requirements for making tax digital can be easier for your end.

With D&V Philippines at your back office, you are guaranteed with high-end support for your F&A functions, even as regulatory updates roll out. You can download our whitepaper Premium Solutions for UK Accounting Firms to know how we can add value to your current accounting services, or schedule a free consultation with our experts.