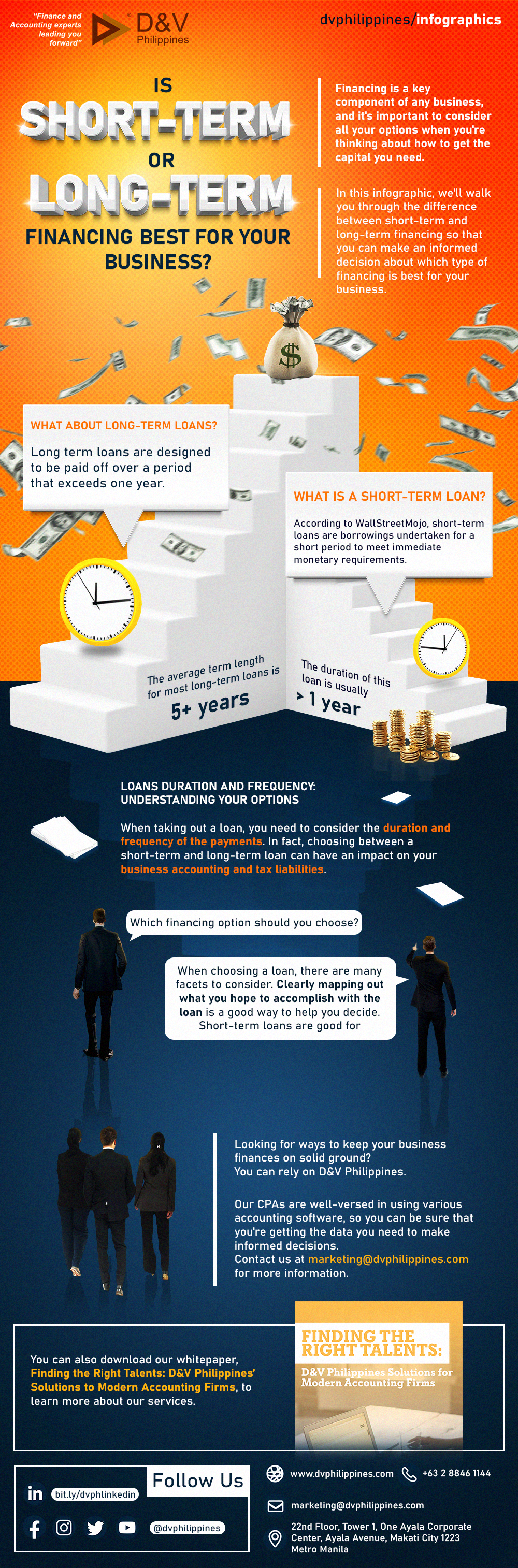

Is Short-term or Long-term Financing Best for Your Business?

Financing is a key component of any business, and it's important to consider all your options when you're thinking about how to get the capital you need.

In this infographic, we'll walk you through the difference between short-term and long-term financing so that you can make an informed decision about which type of financing is best for your business.

First, what is a short-term loan?

According to WallStreetMojo, short-term loans are borrowings undertaken for a short period to meet immediate monetary requirements. The duration of this loan is usually less than one year.

What about long-term loans?

Long term loans are designed to be paid off over a period that exceeds one year. The average term length for most long-term loans is five years or more.

Loans Duration and Frequency: Understanding Your Options

When taking out a loan, you need to consider the duration and frequency of the payments. In fact, choosing between a short-term and long-term loan can have an impact on your business accounting and tax liabilities.

Which financing option should you choose?

When choosing a loan, there are many facets to consider. Clearly mapping out what you hope to accomplish with the loan is a good way to help you decide. Short-term loans are good for short-term goals while long-term loans are ideal for long-term goals.

Looking for ways to keep your business finances on solid ground? You can rely on D&V Philippines. Our CPAs are well-versed in using various accounting software, so you can be sure that you're getting the data you need to make informed decisions. Contact us at marketing@dvphilippines.com for more information. You can also download our whitepaper, Finding the Right Talents: D&V Philippines’ Solutions to Modern Accounting Firms, to learn more about our services.