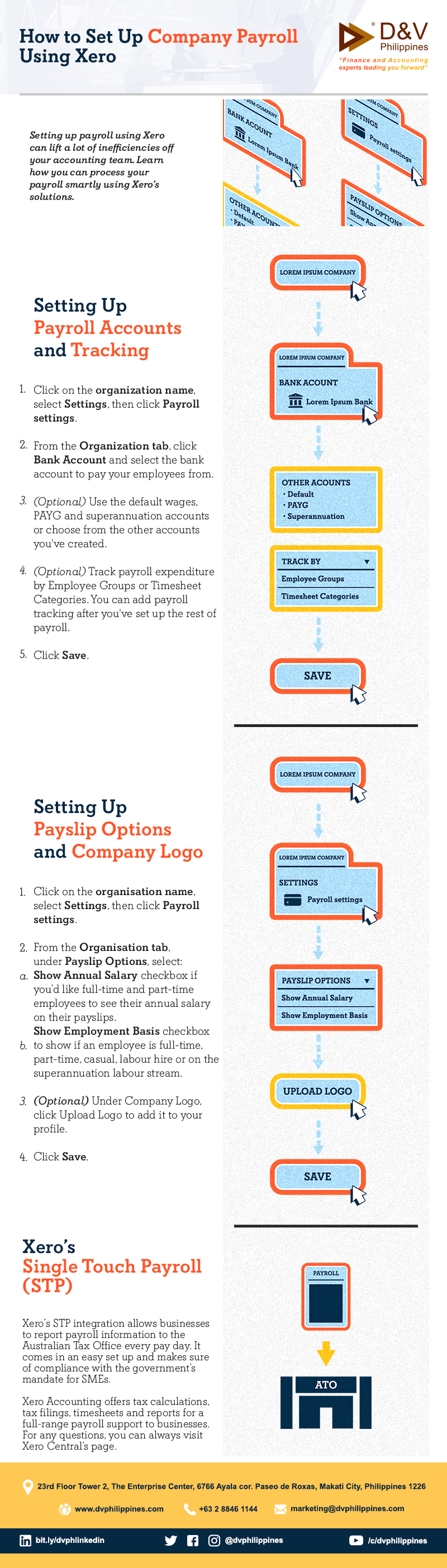

How to Set Up Company Payroll Using Xero

Setting up payroll using Xero can lift a lot of inefficiencies off your accounting team. Learn how you can process your payroll smartly using Xero’s solutions.

Setting Up Payroll Accounts and Tracking

- Click on the organization name, select Settings, then click Payroll settings.

- From the Organization tab, click Bank Account and select the bank account to pay your employees from.

- (Optional) Use the default wages, PAYG and superannuation accounts or choose from the other accounts you've created.

- (Optional) Track payroll expenditure by Employee Groups or Timesheet Categories. You can add payroll tracking after you've set up the rest of payroll.

- Click save.

Setting Up Payslip Options and Company Logo

- Click on the organisation name, select Settings, then click Payroll settings.

- From the Organisation tab, under Payslip Options, select:

- Show Annual Salary checkbox if you’d like full-time and part-time employees to see their annual salary on their payslips.

- Show Employment Basis checkbox to show if an employee is full-time, part-time, casual, labour hire or on the superannuation labour stream.

- (Optional) Under Company Logo, click Upload Logo to add it to your profile.

- Click Save.

Xero’s Single Touch Payroll (STP)

Xero’s STP integration allows businesses to report payroll information to the Australian Tax Office every pay day. It comes in an easy set up and makes sure of compliance with the government’s mandate for SMEs.

Xero Accounting offers tax calculations, tax filings, timesheets and reports for a full-range payroll support to businesses. For any questions, you can always visit Xero Central’s page.

A smarter payroll outsourcing process is one of the best services D&V Philippines can provide your team. You may download our guide Outsourcing: How to Make it Work to learn how we can be your reliable accounting partner here in the Philippines.