Staff Leasing vs Specialised Services: Accounting Outsourcing for CFOs

It is not surprising that some may have difficulty in distinguishing between staff leasing and specialised services.

While both can indeed be considered as outsourcing, there are significant differences in the way they operate.

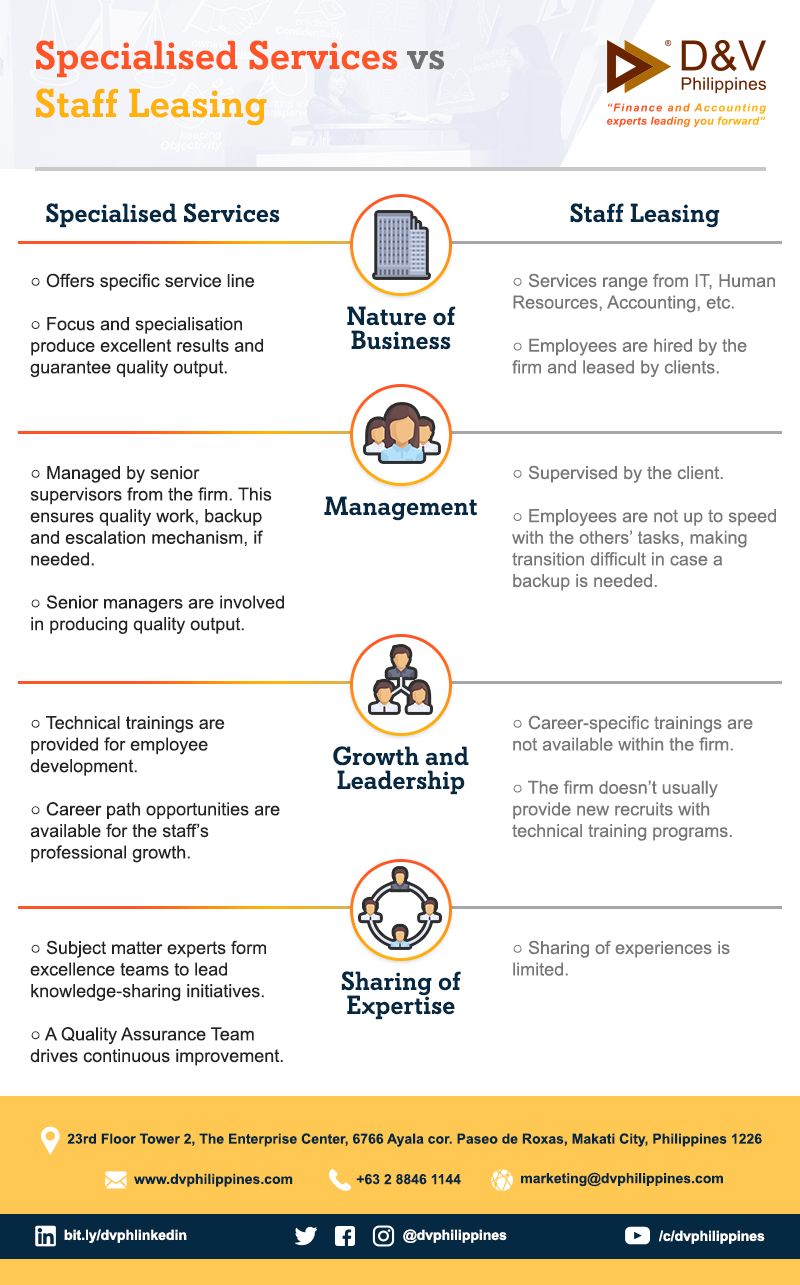

To further differentiate staff leasing from specialised services, please see the infographic below.

Specialised Services vs. Staff Leasing

1. Nature of the Business

Specialised Services

- Offers specific service line

- Focus and specialisation produce excellent results and guarantee quality output.

Staff Leasing

- Services range from IT, Human Resources, Accounting, etc.

- Employees are hired by the firm and leased by clients.

2. Management

Specialised Services

- Managed by senior supervisors from the firm. This ensures quality work, backup and escalation mechanism, if needed.

- Senior managers are involved in producing quality output.

Staff Leasing

-

Supervised by the client.

-

Employees are not up to speed with the others’ tasks, making transition difficult in case a backup is needed.

3. Growth and Leadership

Specialised Services

- Technical trainings are provided for employee development.

- Career path opportunities are available for the staff’s professional growth.

Staff Leasing

- Career-specific trainings are not available within the firm.

- The firm doesn’t usually provide new recruits with technical training programs.

4. Sharing of Expertise

Specialised Services

- Subject matter experts form excellence teams to lead knowledge-sharing initiatives.

- A Quality Assurance Team drives continuous improvement.

Staff Leasing

- Sharing of experiences is limited.