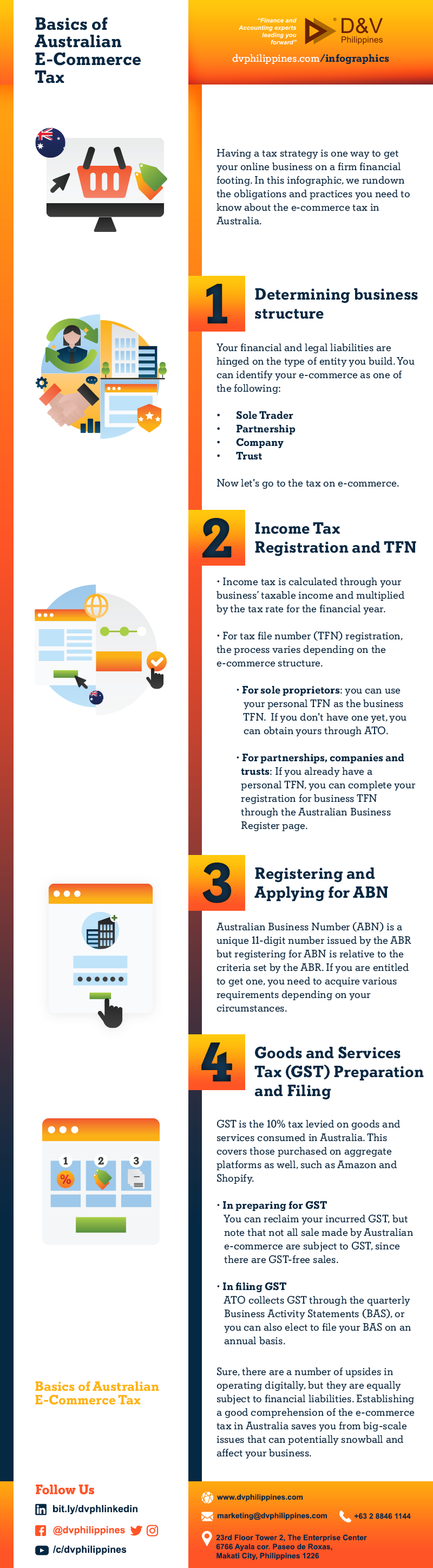

Basics of Australian E-Commerce Tax

Having a tax strategy is one way to get your online business on a firm financial footing. In this infographic, we rundown the obligations and practices you need to know about the e-commerce tax in Australia.

1. Determining business structure

- Your financial and legal liabilities are hinged on the type of entity you build. You can identify your e-commerce as one of the following:

-

- Sole Trader

- Partnership

- Company

- Trust

Now let's go to the tax on e-commerce.

2. Income Tax Registration and TFN

- Income tax is calculated through your business’ taxable income and multiplied by the tax rate for the financial year.

- For tax file number (TFN) registration, the process varies depending on the e-commerce structure.

-

- For sole proprietors: you can use your personal TFN as the business TFN. If you don't have one yet, you can obtain yours through ATO.

- For partnerships, companies and trusts: If you already have a personal TFN, you can complete your registration for business TFN through the Australian Business Register page.

- For sole proprietors: you can use your personal TFN as the business TFN. If you don't have one yet, you can obtain yours through ATO.

3. Registering and Applying for ABN

Australian Business Number (ABN) is a unique 11-digit number issued by the ABR but registering for ABN is relative to the criteria set by the ABR. If you are entitled to get one, you need to acquire various requirements depending on your circumstances.

4. Goods and Services Tax (GST) Preparation and Filing

GST is the 10% tax levied on goods and services consumed in Australia. This covers those purchased on aggregate platforms as well, such as Amazon and Shopify.

- In preparing for GST

You can reclaim your incurred GST, but note that not all sale made by Australian e-commerce are subject to GST, since there are GST-free sales. - In filing GST

ATO collects GST through the quarterly Business Activity Statements (BAS), or you can also elect to file your BAS on an annual basis.

Sure, there are a number of upsides in operating digitally, but they are equally subject to financial liabilities. Establishing a good comprehension of the e-commerce tax in Australia saves you from big-scale issues that can potentially snowball and affect your business.

In need of an e-commerce tax accountant to organise your finances? We're here to help. D&V Philippines provides premium F&A support to e-commerce startups. If you're interested to know how good accounting can help your entity, you can download our guide Finance & Accounting Solutions for E-Commerce Businesses, or you can also schedule a free consultation with our experts.