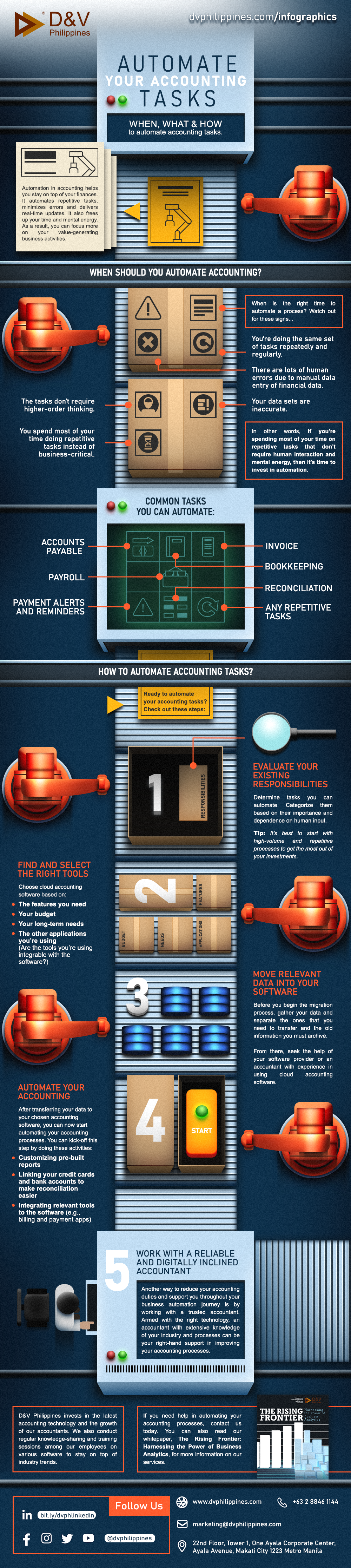

Automate Your Accounting Tasks

Automation in accounting helps you stay on top of your finances. It automates repetitive tasks, minimizes errors and delivers real-time updates. It also frees up your time and mental energy. As a result, you can focus more on your value-generating business activities.

When should you automate accounting?

When is the right time to automate a process? Watch out for these signs:

- You're doing the same set of tasks repeatedly and regularly

- There are lots of human errors due to manual data entry of financial data

- Your data sets are inaccurate

- The tasks don’t require higher-order thinking

- You spend most of your time doing repetitive tasks instead of business-critical functions.

In other words, if you’re spending most of your time on repetitive tasks that don’t require human interaction and mental energy, then it’s time to invest in automation.

Common tasks you can automate

- Accounts payable

- Bookkeeping

- Invoice

- Payroll

- Payment alerts and reminders

- Reconciliation

- And any repetitive tasks

How to automate accounting tasks?

Ready to automate your accounting tasks? Check out these steps:

1. Evaluate your existing responsibilities

Determine tasks you can automate. Categorize them based on their importance and dependence on human input.

Tip: It's best to start with high-volume and repetitive processes to get the most out of your investments.

2. Find and select the right tools

Choose cloud accounting software based on:

- The features you need

- Your budget

- Your long-term needs

- The other applications you’re using (Are the tools you’re using integrable with the software?)

3. Move relevant data into your software

Before you begin the migration process, gather your data and separate the ones that you need to transfer and the old information you must archive.

From there, seek the help of your software provider or an accountant with experience in using cloud accounting software.

4. Automate your accounting

After transferring your data to your chosen accounting software, you can now start automating your accounting processes. You can kick-off this step by doing these activities:

- Customizing pre-built reports

- Linking your credit cards and bank accounts to make reconciliation easier

- Integrating relevant tools to the software (e.g., billing and payment apps)

5. Work with a reliable and digitally inclined accountant

Another way to reduce your accounting duties and support you throughout your business automation journey is by working with a trusted accountant. Armed with the right technology, an accountant with extensive knowledge of your industry and processes can be your right-hand support in improving your accounting processes.

D&V Philippines invests in the latest accounting technology and the growth of our accountants. We also conduct regular knowledge-sharing and training sessions among our employees on various software to stay on top of industry trends.

If you need help in automating your accounting processes, contact us today. You can also read our whitepaper, The Rising Frontier: Harnessing the Power of Business Analytics, for more information on our services.