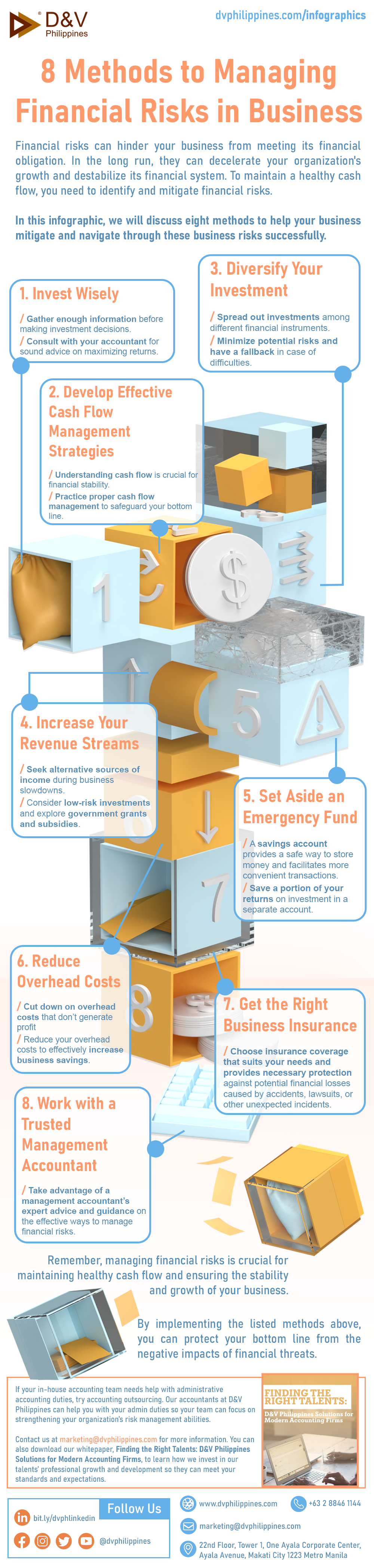

8 Methods to Managing Financial Risks in Business

Financial risks can hinder your business from meeting its financial obligation. In the long run, they can decelerate your organization's growth and destabilize its financial system. To maintain a healthy cash flow, you need to identify and mitigate financial risks. In this infographic, we will discuss eight methods to help your business mitigate and navigate through these business risks successfully.

1. Invest Wisely

- Gather enough information before making investment decisions.

- Consult with your accountant for sound advice on maximizing returns.

2. Develop Effective Cash Flow Management Strategies

- Understanding cash flow is crucial for financial stability.

- Practice proper cash flow management to safeguard your bottom line.

3. Diversify Your Investment

- Spread out investments among different financial instruments.

- Minimize potential risks and have a fallback in case of difficulties.

4. Increase Your Revenue Streams

- Seek alternative sources of income during business slowdowns.

- Consider low-risk investments and explore government grants and subsidies.

5. Set Aside an Emergency Fund

- A savings account provides a safe way to store money and facilitates more convenient transactions.

- Save a portion of your returns on investment in a separate account.

6. Reduce Overhead Costs

- Cut down on overhead costs that don’t generate profit

- Reduce your overhead costs to effectively increase business savings.

7. Get the Right Business Insurance

- Choose insurance coverage that suits your needs and provides necessary protection against potential financial losses caused by accidents, lawsuits, or other unexpected incidents.

8. Work with a Trusted Management Accountant

- Take advantage of a management accountant’s expert advice and guidance on the effective ways to manage financial risks.

Remember, managing financial risks is crucial for maintaining healthy cash flow and ensuring the stability and growth of your business. By implementing the listed methods above, you can protect your bottom line from the negative impacts of financial threats.

If your in-house accounting team needs help with administrative accounting duties, try accounting outsourcing. Our accountants at D&V Philippines can help you with your admin duties so your team can focus on strengthening your organization’s risk management abilities.

Contact us at marketing@dvphilippines.com for more information. You can also download our whitepaper, Finding the Right Talents: D&V Philippines Solutions for Modern Accounting Firms, to learn how we invest in our talents’ professional growth and development so they can meet your standards and expectations.