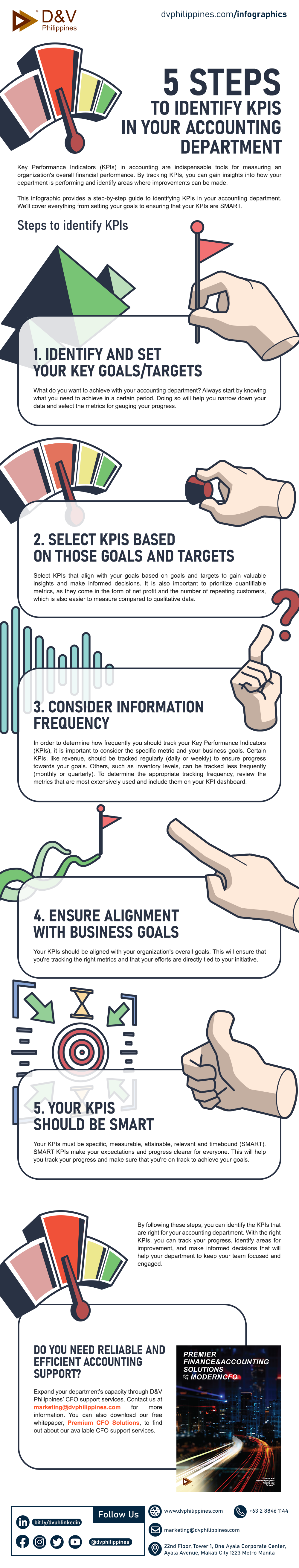

5 Steps to Identify KPIs in Your Accounting Department

Key Performance Indicators (KPIs) in accounting are indispensable tools for measuring an organization's overall financial performance. By tracking KPIs, you can gain insights into how your department is performing and identify areas where improvements can be made.

This infographic provides a step-by-step guide to identifying KPIs in your accounting department. We'll cover everything from setting your goals to ensuring that your KPIs are SMART.

Steps to identify KPIs

1. Identify and set your key goals/targets

What do you want to achieve with your accounting department? Always start by knowing what you need to achieve in a certain period. Doing so will help you narrow down your data and select the metrics for gauging your progress.

2. Select KPIs based on those goals and targets

Select KPIs that align with your goals based on goals and targets to gain valuable insights and make informed decisions. It is also important to prioritize quantifiable metrics, as they come in the form of net profit and the number of repeating customers, which is also easier to measure compared to qualitative data.

3. Consider information frequency

In order to determine how frequently you should track your Key Performance Indicators (KPIs), it is important to consider the specific metric and your business goals. Certain KPIs, like revenue, should be tracked regularly (daily or weekly) to ensure progress towards your goals. Others, such as inventory levels, can be tracked less frequently (monthly or quarterly). To determine the appropriate tracking frequency, review the metrics that are most extensively used and include them on your KPI dashboard.

4. Ensure alignment with business goals

Your KPIs should be aligned with your organization's overall goals. This will ensure that you're tracking the right metrics and that your efforts are directly tied to your initiative.

5. Your KPIs should be SMART

Your KPIs must be specific, measurable, attainable, relevant and timebound (SMART). SMART KPIs make your expectations and progress clearer for everyone. This will help you track your progress and make sure that you're on track to achieve your goals.

By following these steps, you can identify the KPIs that are right for your accounting department. With the right KPIs, you can track your progress, identify areas for improvement, and make informed decisions that will help your department to keep your team focused and engaged.

Do you need reliable and efficient accounting support? Expand your department’s capacity through D&V Philippines’ CFO support services. Contact us at marketing@dvphilippines.com for more information. You can also download our free whitepaper, Premium CFO Solutions, to find out about our available CFO support services.