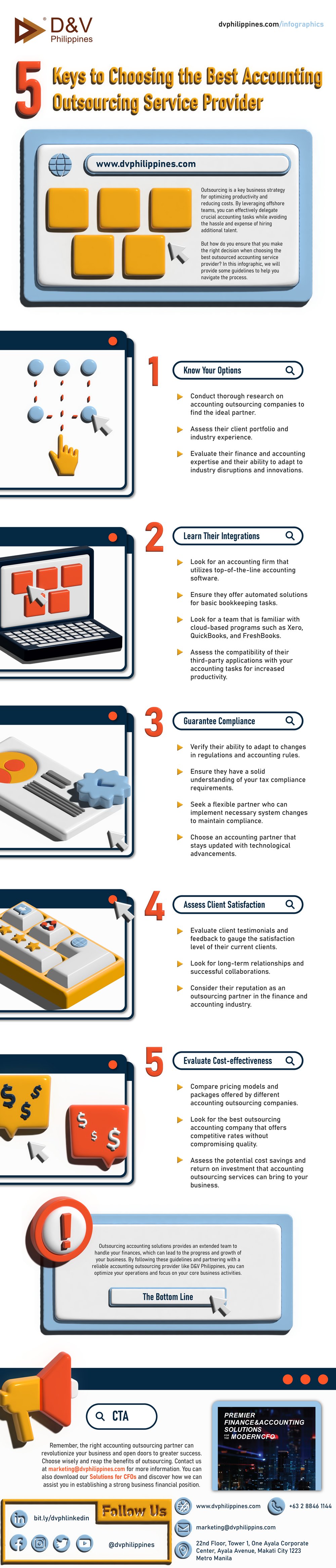

5 Keys to Choosing the Best Accounting Outsourcing Service Provider

Outsourcing is a key business strategy for optimizing productivity and reducing costs. By leveraging offshore teams, you can effectively delegate crucial accounting tasks while avoiding the hassle and expense of hiring additional talent.

But how do you ensure that you make the right decision when choosing the best outsourced accounting service provider? In this infographic, we will provide some guidelines to help you navigate the process.

1. Know Your Options

- Conduct thorough research on accounting outsourcing companies to find the ideal partner.

- Assess their client portfolio and industry experience.

- Evaluate their finance and accounting expertise and their ability to adapt to industry disruptions and innovations.

2. Learn Their Integrations

- Look for an accounting firm that utilizes top-of-the-line accounting software.

- Ensure they offer automated solutions for basic bookkeeping tasks.

- Look for a team that is familiar with cloud-based programs such as Xero, QuickBooks, and FreshBooks.

- Assess the compatibility of their third-party applications with your accounting tasks for increased productivity.

3. Guarantee Compliance

- Verify their ability to adapt to changes in regulations and accounting rules.

- Ensure they have a solid understanding of your tax compliance requirements.

- Seek a flexible partner who can implement necessary system changes to maintain compliance.

- Choose an accounting partner that stays updated with technological advancements.

4. Assess Client Satisfaction

- Evaluate client testimonials and feedback to gauge the satisfaction level of their current clients.

- Look for long-term relationships and successful collaborations.

- Consider their reputation as an outsourcing partner in the finance and accounting industry.

5. Evaluate Cost-effectiveness

- Compare pricing models and packages offered by different accounting outsourcing companies.

- Look for the best outsourcing accounting company that offers competitive rates without compromising quality.

- Assess the potential cost savings and return on investment that accounting outsourcing services can bring to your business.

The Bottom Line

Outsourcing accounting solutions provides an extended team to handle your finances, which can lead to the progress and growth of your business. By following these guidelines and partnering with a reliable accounting outsourcing provider like D&V Philippines, you can optimize your operations and focus on your core business activities.

Remember, the right accounting outsourcing partner can revolutionize your business and open doors to greater success. Choose wisely and reap the benefits of outsourcing. Contact us at marketing@dvphilippines.com for more information. You can also download our Solutions for CFOs and discover how we can assist you in establishing a strong business financial position.