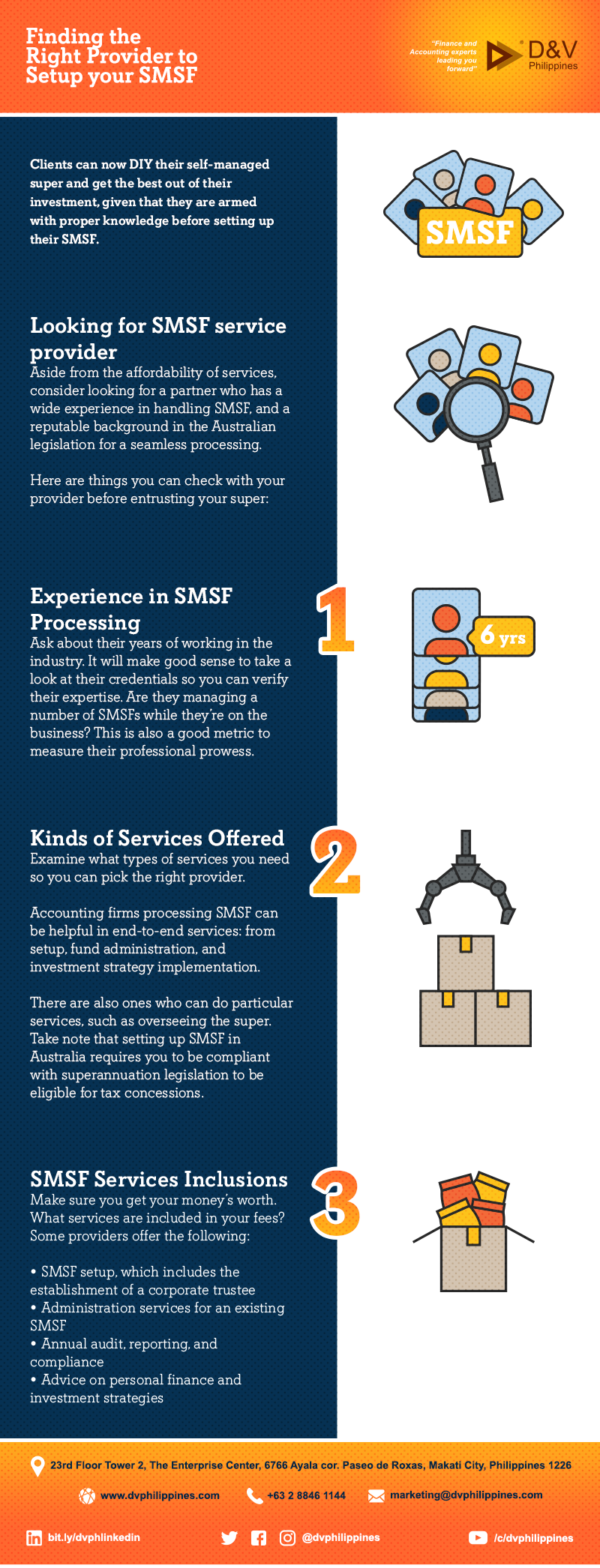

Clients can now DIY their self-managed super and get the best out of their investment, given that they are armed with proper knowledge before setting up their SMSF.

Aside from the affordability of services, consider looking for a partner who has a wide experience in handling SMSF, and a reputable background in the Australian legislation for a seamless processing.

Here are things you can check with your provider before entrusting your super:

Ask about their years of working in the industry. It will make good sense to take a look at their credentials so you can verify their expertise. Are they managing a number of SMSFs while they’re on the business? This is also a good metric to measure their professional prowess.

Examine what types of services you need so you can pick the right provider.

Accounting firms processing SMSF can be helpful in end-to-end services: from setup, fund administration, and investment strategy implementation.

There are also ones who can do particular services, such as overseeing the super. Take note that setting up SMSF in Australia requires you to be compliant with superannuation legislation to be eligible for tax concessions.

Make sure you get your money’s worth. What services are included in your fees? Some providers offer the following:

Gain more control of your retirement fund by setting up your SMSF. Before managing your own super fund, make sure you entrust your SMSF to the right partner.

Let D&V Philippines be the provider you’re looking for. We provide high-end finance and accounting services for accounting firms in Australia, including financial management, paraplanning, and SMSF administration. You can get our Talent Sourcing whitepaper and see how our in-house experts can deliver quality F&A solutions for you today.