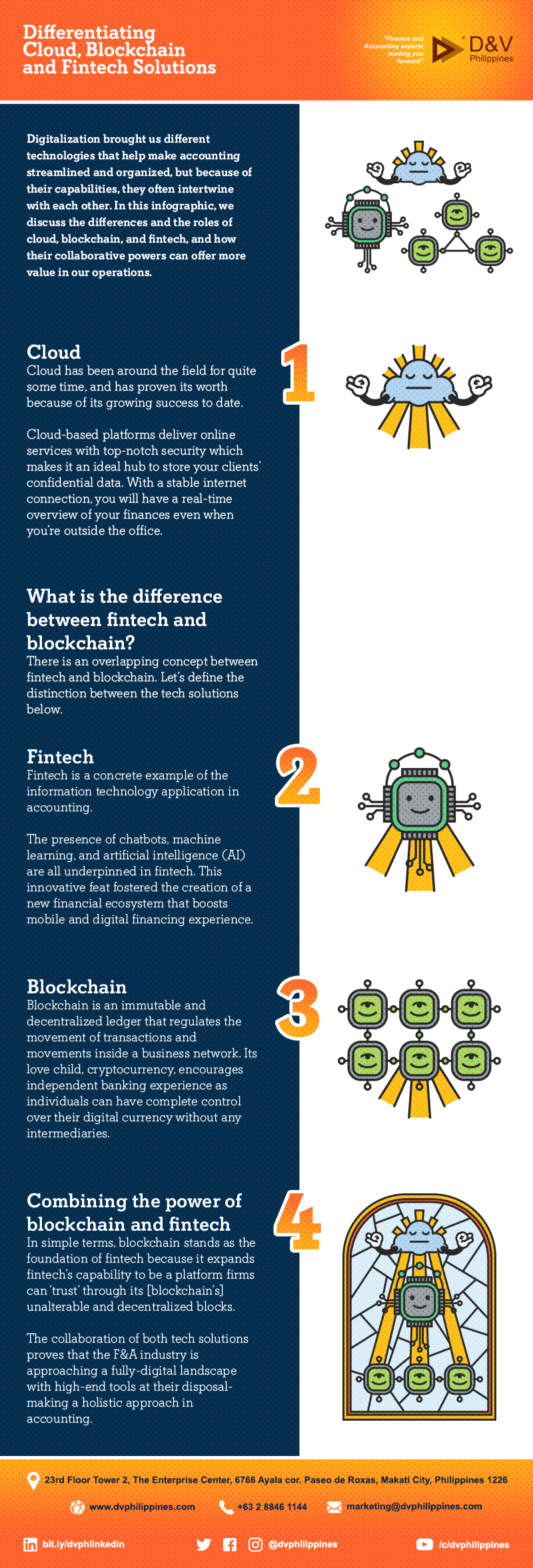

Differentiating Cloud, Blockchain and Fintech Solutions

Digitalization brought us different technologies that help make accounting streamlined and organized, but because of their capabilities, they often intertwine with each other. In this infographic, we discuss the differences and the roles of cloud, blockchain, and fintech, and how their collaborative powers can offer more value in our operations.

Cloud

Cloud has been around the field for quite some time, and has proven its worth because of its growing success to date.

Cloud-based platforms deliver online services with top-notch security which makes it an ideal hub to store your clients’ confidential data. With a stable internet connection, you will have a real-time overview of your finances even when you’re outside the office.

What is the difference between fintech and blockchain?

There is an overlapping concept between fintech and blockchain. Let’s define the distinction between the tech solutions below.

Fintech

Fintech is a concrete example of the information technology application in accounting.

The presence of chatbots, machine learning, and artificial intelligence (AI) are all underpinned in fintech. This innovative feat fostered the creation of a new financial ecosystem that boosts mobile and digital financing experience.

Blockchain

Blockchain is an immutable and decentralized ledger that regulates the movement of transactions and movements inside a business network. Its love child, cryptocurrency, encourages independent banking experience as individuals can have complete control over their digital currency without any intermediaries.

Combining the power of blockchain and fintech

In simple terms, blockchain stands as the foundation of fintech because it expands fintech’s capability to be a platform firms can ‘trust’ through its [blockchain’s] unalterable and decentralized blocks.

The collaboration of both tech solutions proves that the F&A industry is approaching a fully-digital landscape with high-end tools at their disposal- making a holistic approach in accounting.

The rise of innovation shows how advanced the field has become today. In addition, the impact of technology changes in accounting better catered the demands of digital-savvy consumers of today. We remain to see how the potentials of the cloud, blockchain, and fintech work together and fuel the progress towards digitalization.

If you're looking for an accounting partner armed with the right technology, and have accountants with the technical expertise, look no further than D&V Philippines. You can get our latest whitepaper, Finding the Right Talents: D&V Philippines’ Solutions to Modern Accounting Firms to know how we can be your reliable back-office accounting team.