Is Payroll Outsourcing For You?

Non-core functions such as payroll, administrative, and back-office tasks of businesses have long been recommended by business advisors to be outsourced, as these do not directly affect the strategy of a company or how it profits. Needless to say, this is mainly to save companies a great deal of time and resources in the long run. However, among these non-core functions, payroll is the most critical in many ways—it takes up a lot of time, manpower, and technicalities, and doing it wrongly can cause severe damages for any company.

Whether you’re looking to manage payroll for a small business or a large corporation, we’re sure that you have your own hesitations about payroll outsourcing. Is it worth it to exert time and effort to explore the different payroll outsourcing providers and go through transitioning to that third party? Here are some points to ponder on to help you figure out if outsourcing your payroll is right for you.

1. You want to focus more on your core business.

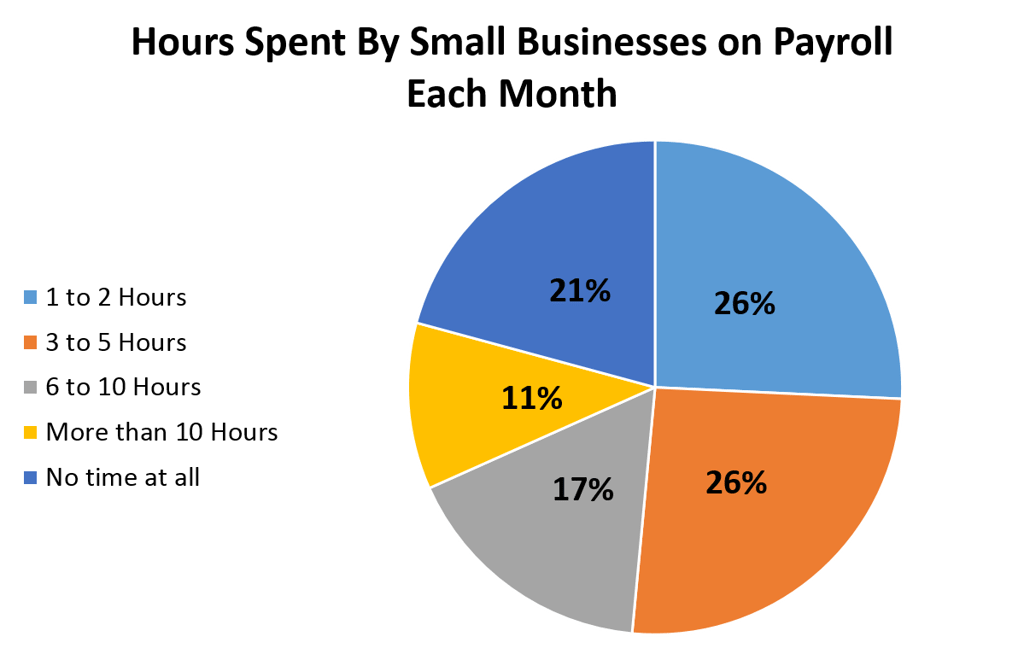

Let’s do the math, shall we? A study conducted by Score, a nonprofit organisation for SMEs, concluded the following number of hours utilised by small businesses who do their payroll in-house.

Source: Score

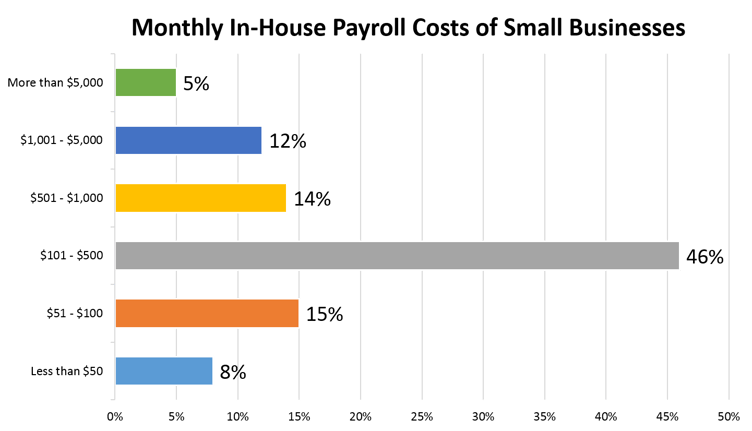

This just means that companies spend anywhere from 12 hours to 120 hours per year on managing payroll. In addition to that, these businesses spend from below $50 to $5,000 per month to be able to accomplish their payroll processes, with majority spending an average of $101 to $500.

Source: Score

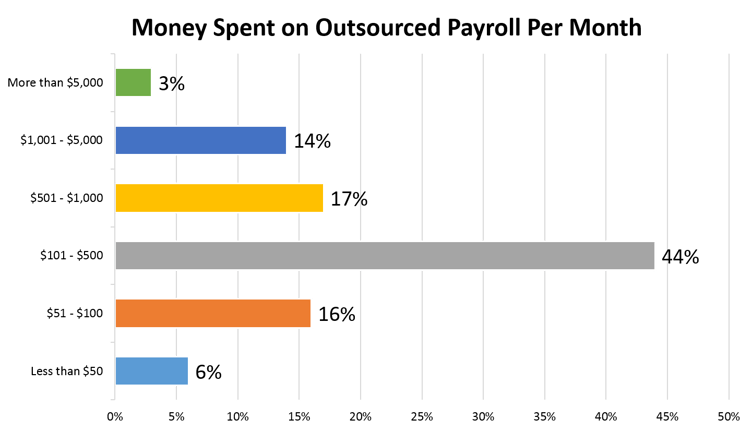

Another study done by The National Small Business Association (NSBA) concludes that out of the surveyed 1,500 small business owners, 40% of them outsource their payroll. If you look closely, these companies spend almost the same amount as doing payroll in-house. This simply means that it costs just about the same to have payroll outsourced!

Source: NSBA via The New Talent Times

The time that you have saved from doing payroll in-house can be used for a myriad of things to grow your business—developing new products, finding prospects, networking, trainings, marketing efforts, and so many other activities. Choosing now is all a matter of perspective, on whether you want to handle it fully on your own, or trust off-premise specialists to do it for you.

2. You want to get access to expertise and technology without liability.

Adding another employee or more to manage payroll is another employee added on your payroll, requiring you to provide all employee benefits and the little extras. Of course you need to hire someone who is highly proficient in payroll, and have them attend trainings or refresher courses to make sure they’re completely updated with the latest tax changes. On top of that, you have to invest in your own payroll software, and take care of the maintenance and updates of those too.

For large companies who can afford it, it can be cheaper to have their payroll processing in-house especially if they have thousands of employees to pay, as payroll service providers usually charge by pay slip or volume of work. However, payroll outsourcing services might be the better option for smaller businesses as they can get an enterprise-level payroll solution—expertise and leading technology—without the added responsibilities on their part.

3. You are thinking ahead.

If you envision your company growing significantly in the near future and want to prepare for the increased payroll responsibilities, outsourcing to a payroll service provider can ensure that you are covered. Scalability with little or no downtime at all is one of the greatest benefits that outsourcing can provide you with.

4. You want to reduce costly risks.

Payroll mistakes are very common for companies that don’t take the extra effort to have their payroll personnel professionally trained and updated on the latest taxes and legislations on salaries. Let’s face it, not all companies give high importance to this task. Outsourced payroll services providers are specifically trained for that purpose, which makes them less likely to commit errors when doing your payroll. And when errors do happen, you can always file legal claims depending on the contract terms agreed upon.

Every company has their own priorities, and if you want to prioritise having more time on your hands and having the peace of mind that you are fulfilling salaries and taxes correctly, then it’s about time you let payroll specialists take over that aspect of your business.

D&V’s Payroll Solutions makes it possible to achieve all these and more, so you stop getting bogged down with the details and actually take control of your business. Schedule a free consultation with us now and let our payroll specialists recommend the ideal payroll solution for your business.