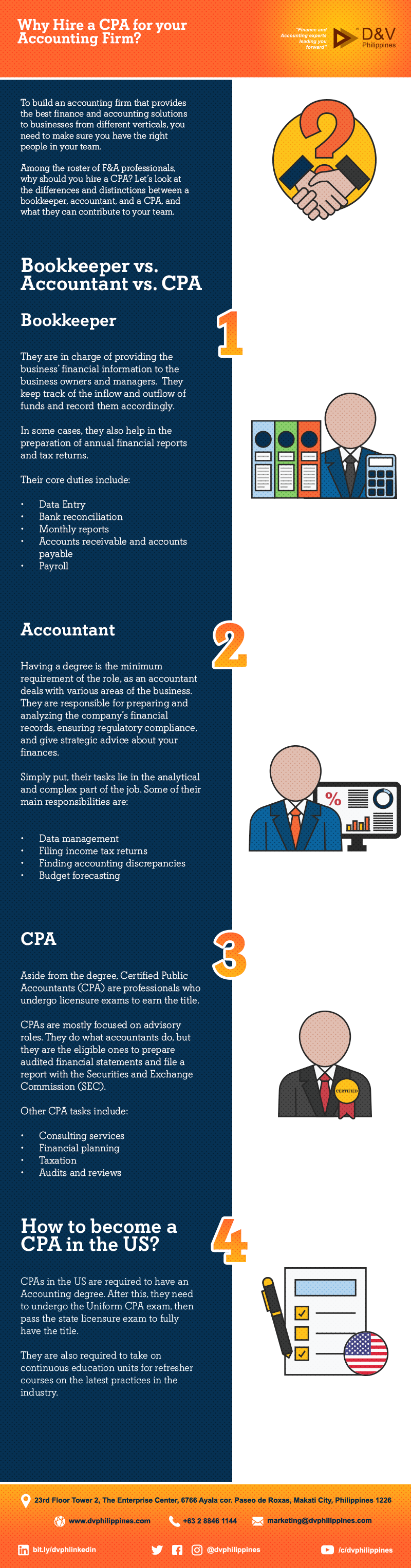

To build an accounting firm that provides the best finance and accounting solutions to businesses from different verticals, you need to make sure you have the right people in your team.

Among the roster of F&A professionals, why should you hire a CPA? Let’s look at the differences and distinctions between a bookkeeper, accountant, and a CPA, and what they can contribute to your team.

They are in charge of providing the business’ financial information to the business owners and managers. They keep track of the inflow and outflow of funds and record them accordingly.

In some cases, they also help in the preparation of annual financial reports and tax returns.

Their core duties include:

Having a degree is the minimum requirement of the role, as an accountant deals with various areas of the business. They are responsible for preparing and analyzing the company’s financial records, ensuring regulatory compliance, and give strategic advice about your finances.

Simply put, their tasks lie in the analytical and complex part of the job. Some of their main responsibilities are:

Aside from the degree, Certified Public Accountants (CPA) are professionals who undergo licensure exams to earn the title.

CPAs are mostly focused on advisory roles. They do what accountants do, but they are the eligible ones to prepare audited financial statements and file a report with the Securities and Exchange Commission (SEC).

Other CPA tasks include:

CPAs in the US are required to have an Accounting degree. After this, they need to undergo the Uniform CPA exam, then pass the state licensure exam to fully have the title.

They are also required to take on continuous education units for refresher courses on the latest practices in the industry.

Hiring a CPA is more of an investment for your growing firm. With their extensive knowledge and perpetual learning, you have a strong guarantee that your finance and accounting processes are well taken care of by experts. In addition, they are helpful in legal matters. They can represent you when you’re audited by any government office such as the Internal Revenue Service (IRS).

As your operations scale, you need more people onboard to do the job. Let us help you in your F&A processes when you outsource your accounting functions to us.

D&V Philippines has over 500 finance and accounting experts that can professionally work your finances. Grab your copy of our latest whitepaper D&V Philippines’ Solutions for Modern Accounting Firms to know how we can add value to your services, or contact us today for a consultation.